- Hong Kong

- /

- Construction

- /

- SEHK:6829

Here's Why We Think Dragon Rise Group Holdings (HKG:6829) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Dragon Rise Group Holdings (HKG:6829), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Dragon Rise Group Holdings

Dragon Rise Group Holdings' Improving Profits

Over the last three years, Dragon Rise Group Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In previous twelve months, Dragon Rise Group Holdings' EPS has risen from HK$0.0062 to HK$0.0066. That's a fair increase of 6.6%.

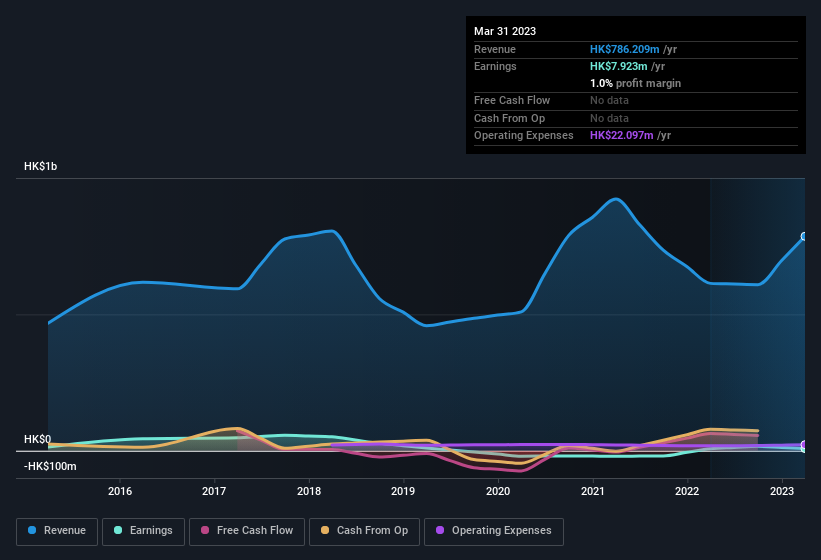

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Dragon Rise Group Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 28% to HK$786m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Dragon Rise Group Holdings isn't a huge company, given its market capitalisation of HK$202m. That makes it extra important to check on its balance sheet strength.

Are Dragon Rise Group Holdings Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Dragon Rise Group Holdings will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 74% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. In terms of absolute value, insiders have HK$150m invested in the business, at the current share price. So there's plenty there to keep them focused!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Dragon Rise Group Holdings, with market caps under HK$1.6b is around HK$1.8m.

The Dragon Rise Group Holdings CEO received total compensation of just HK$819k in the year to March 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Dragon Rise Group Holdings Deserve A Spot On Your Watchlist?

As previously touched on, Dragon Rise Group Holdings is a growing business, which is encouraging. The fact that EPS is growing is a genuine positive for Dragon Rise Group Holdings, but the pleasant picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. We don't want to rain on the parade too much, but we did also find 4 warning signs for Dragon Rise Group Holdings (1 doesn't sit too well with us!) that you need to be mindful of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6829

Dragon Rise Group Holdings

An investment holding company, operates as a subcontractor of foundation works in Hong Kong.

Moderate with adequate balance sheet.

Market Insights

Community Narratives