- China

- /

- Semiconductors

- /

- SZSE:300223

3 Asian Growth Companies With Insider Ownership Expecting Up To 34% Earnings Growth

Reviewed by Simply Wall St

As global markets grapple with escalating trade tensions, particularly between the U.S. and China, investor sentiment has been volatile, impacting indices across Asia. In such an uncertain environment, companies that demonstrate strong insider ownership can be appealing as this often signals confidence in the company's long-term growth potential.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 27% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| UTour Group (SZSE:002707) | 23.5% | 32.7% |

| Synspective (TSE:290A) | 12.8% | 44.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

We'll examine a selection from our screener results.

Techtronic Industries (SEHK:669)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products internationally with a market cap of HK$138.28 billion.

Operations: The company generates revenue primarily from its Power Equipment segment, which accounts for $13.72 billion, followed by the Floorcare & Cleaning segment at $912.03 million.

Insider Ownership: 22.1%

Earnings Growth Forecast: 15.1% p.a.

Techtronic Industries, trading significantly below its estimated fair value, showcases robust growth potential with earnings forecasted to rise by 15.07% annually, outpacing the Hong Kong market. Recent board changes and proposed amendments to company bylaws may enhance governance and operational flexibility. The company completed a share buyback worth US$31.89 million while reporting increased sales of US$14.62 billion for 2024, reflecting solid financial health without substantial insider trading activity recently observed.

- Delve into the full analysis future growth report here for a deeper understanding of Techtronic Industries.

- Insights from our recent valuation report point to the potential undervaluation of Techtronic Industries shares in the market.

Ingenic SemiconductorLtd (SZSE:300223)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ingenic Semiconductor Co., Ltd. focuses on the research, development, design, and sale of integrated circuit chip products both in China and internationally, with a market cap of CN¥33.28 billion.

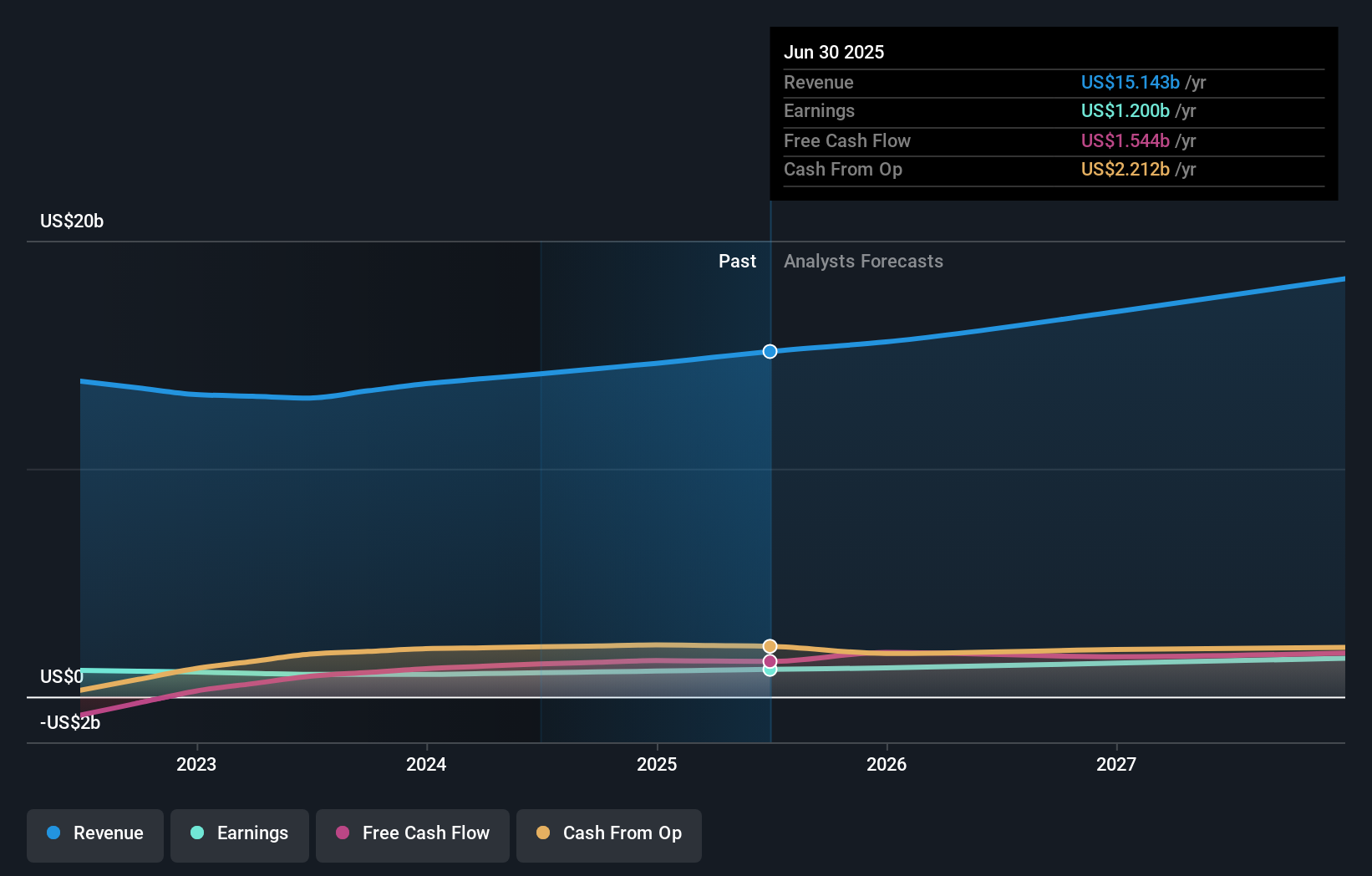

Operations: Ingenic Semiconductor Co., Ltd. generates revenue primarily through the research, development, design, and sale of integrated circuit chip products both domestically and internationally.

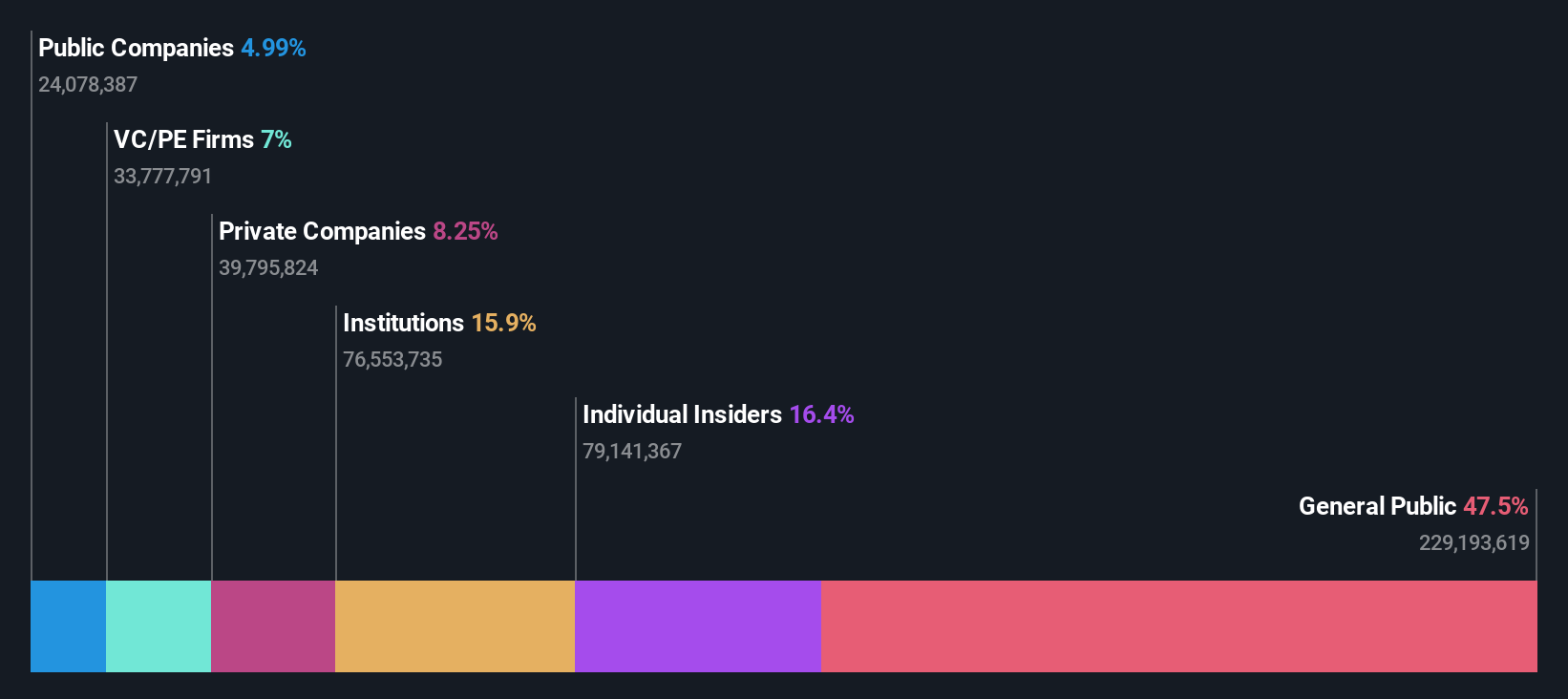

Insider Ownership: 16.6%

Earnings Growth Forecast: 34.3% p.a.

Ingenic Semiconductor Ltd. demonstrates strong growth prospects with earnings expected to increase by 34.27% annually, surpassing the broader Chinese market's growth rate of 24%. Revenue is also projected to rise significantly at 25.1% per year, outpacing market averages. Despite these positive forecasts, the company faces challenges with a highly volatile share price and a low Return on Equity forecast of 7.6% in three years, without recent substantial insider trading activity noted.

- Click to explore a detailed breakdown of our findings in Ingenic SemiconductorLtd's earnings growth report.

- Upon reviewing our latest valuation report, Ingenic SemiconductorLtd's share price might be too optimistic.

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. operates as a provider of IT services and solutions, with a market cap of CN¥51.57 billion.

Operations: Revenue segments for SZSE:301236 are not provided in the given text.

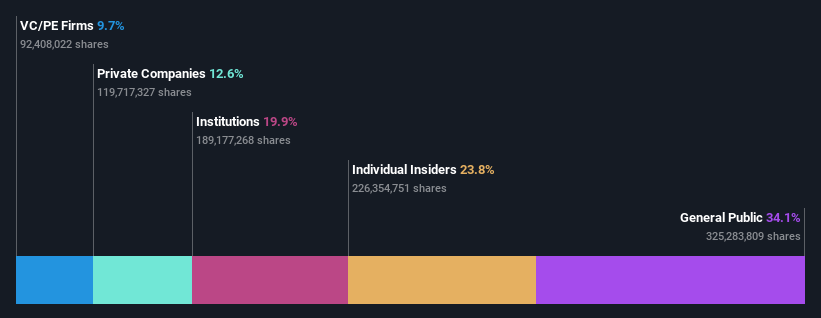

Insider Ownership: 23.8%

Earnings Growth Forecast: 28.4% p.a.

iSoftStone Information Technology (Group) is poised for growth with earnings expected to increase by 28.4% annually, outpacing the Chinese market's 24% growth rate. Revenue is forecasted to grow at 15.4% per year, also exceeding market averages. Despite these promising figures, the company faces challenges such as a low Return on Equity forecast of 6.7% in three years and recent volatility in its share price without significant insider trading activity reported recently.

- Get an in-depth perspective on iSoftStone Information Technology (Group)'s performance by reading our analyst estimates report here.

- Our valuation report here indicates iSoftStone Information Technology (Group) may be undervalued.

Key Takeaways

- Click here to access our complete index of 636 Fast Growing Asian Companies With High Insider Ownership.

- Contemplating Other Strategies? We've found 25 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300223

Ingenic SemiconductorLtd

Engages in the research and development, design, and sale of integrated circuit chip products in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives