- Hong Kong

- /

- Electrical

- /

- SEHK:666

Investors Interested In REPT BATTERO Energy Co., Ltd.'s (HKG:666) Revenues

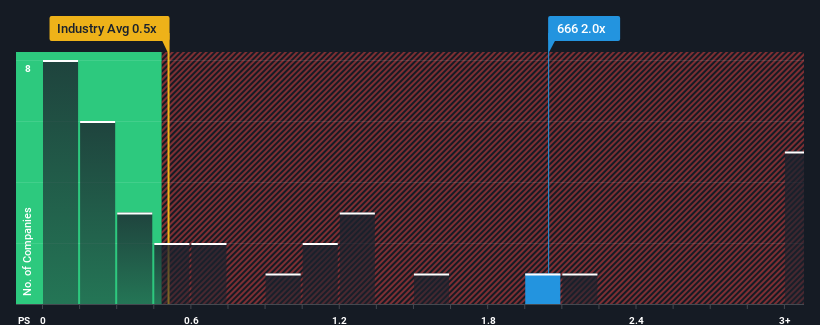

When close to half the companies in the Electrical industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.5x, you may consider REPT BATTERO Energy Co., Ltd. (HKG:666) as a stock to potentially avoid with its 2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for REPT BATTERO Energy

What Does REPT BATTERO Energy's Recent Performance Look Like?

Recent times haven't been great for REPT BATTERO Energy as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on REPT BATTERO Energy.Is There Enough Revenue Growth Forecasted For REPT BATTERO Energy?

There's an inherent assumption that a company should outperform the industry for P/S ratios like REPT BATTERO Energy's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.1%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Looking ahead now, revenue is anticipated to climb by 48% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 16% each year, which is noticeably less attractive.

With this information, we can see why REPT BATTERO Energy is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From REPT BATTERO Energy's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that REPT BATTERO Energy maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for REPT BATTERO Energy with six simple checks on some of these key factors.

If you're unsure about the strength of REPT BATTERO Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:666

REPT BATTERO Energy

Engages in the research, design, development, production, and sale of lithium-ion battery products in China and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives