Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Fosun International Limited (HKG:656) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Fosun International

What Is Fosun International's Net Debt?

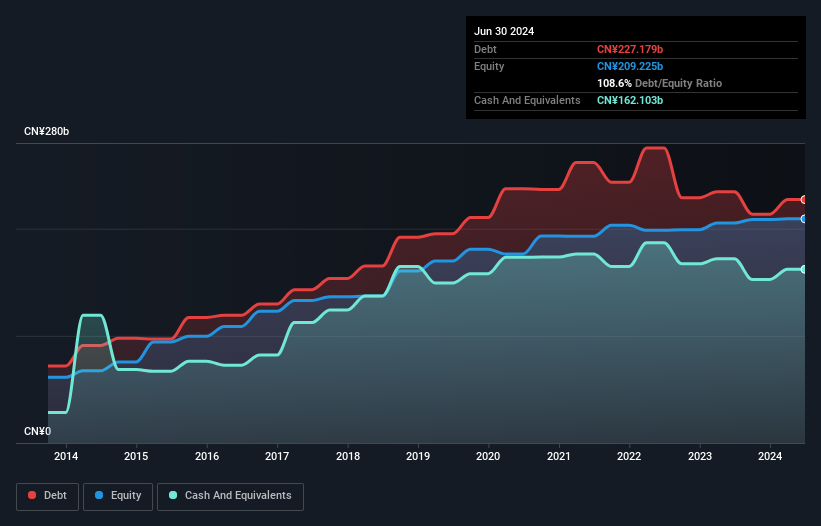

As you can see below, Fosun International had CN¥227.2b of debt, at June 2024, which is about the same as the year before. You can click the chart for greater detail. However, it also had CN¥162.1b in cash, and so its net debt is CN¥65.1b.

How Strong Is Fosun International's Balance Sheet?

We can see from the most recent balance sheet that Fosun International had liabilities of CN¥344.6b falling due within a year, and liabilities of CN¥268.1b due beyond that. On the other hand, it had cash of CN¥162.1b and CN¥66.5b worth of receivables due within a year. So its liabilities total CN¥384.1b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the CN¥33.8b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Fosun International would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Fosun International can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Fosun International reported revenue of CN¥199b, which is a gain of 7.6%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Over the last twelve months Fosun International produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping CN¥4.0b. When you combine this with the very significant balance sheet liabilities mentioned above, we are so wary of it that we are basically at a loss for the right words. Sure, the company might have a nice story about how they are going on to a brighter future. But the fact is that it incinerated CN¥2.2b of cash in the last twelve months, and has precious few liquid assets in comparison to its liabilities. So is this a high risk stock? We think so, and we'd avoid it. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example - Fosun International has 1 warning sign we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade Fosun International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:656

Fosun International

Operates in the health, happiness, wealth, and intelligent manufacturing sectors in Mainland China, Portugal, and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives