Tony Tse is the CEO of E. Bon Holdings Limited (HKG:599), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also assess whether E. Bon Holdings pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for E. Bon Holdings

How Does Total Compensation For Tony Tse Compare With Other Companies In The Industry?

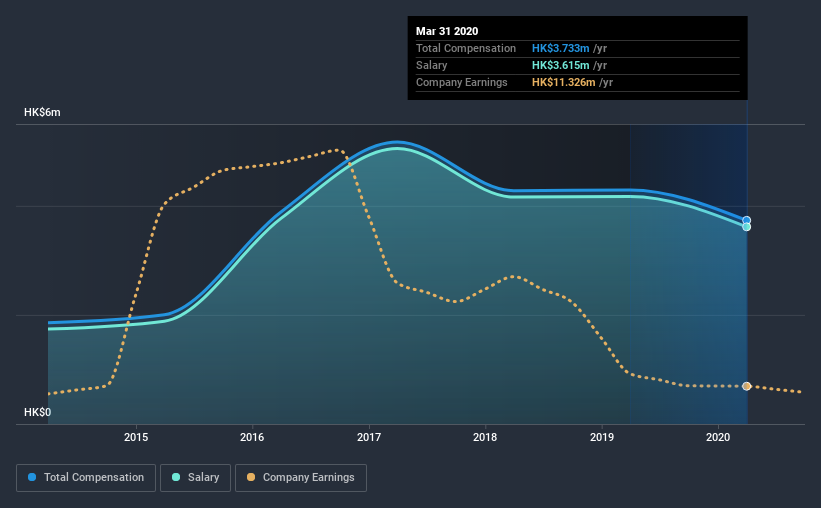

At the time of writing, our data shows that E. Bon Holdings Limited has a market capitalization of HK$177m, and reported total annual CEO compensation of HK$3.7m for the year to March 2020. Notably, that's a decrease of 13% over the year before. We note that the salary portion, which stands at HK$3.62m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.6m. Hence, we can conclude that Tony Tse is remunerated higher than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$3.6m | HK$4.2m | 97% |

| Other | HK$118k | HK$118k | 3% |

| Total Compensation | HK$3.7m | HK$4.3m | 100% |

Speaking on an industry level, nearly 92% of total compensation represents salary, while the remainder of 7.7% is other remuneration. E. Bon Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

E. Bon Holdings Limited's Growth

E. Bon Holdings Limited has reduced its earnings per share by 36% a year over the last three years. Its revenue is down 13% over the previous year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has E. Bon Holdings Limited Been A Good Investment?

Given the total shareholder loss of 43% over three years, many shareholders in E. Bon Holdings Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

Tony receives almost all of their compensation through a salary. As previously discussed, Tony is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. Arguably worse, we've been waiting for positive EPS growth for the last three years. Overall, with such poor performance, shareholder's would probably have questions if the company decided to give the CEO a raise.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for E. Bon Holdings (1 is a bit unpleasant!) that you should be aware of before investing here.

Switching gears from E. Bon Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading E. Bon Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if E. Bon Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:599

E. Bon Holdings

An investment holding company, engages in the importing, wholesale, retail and installation of architectural builders’ hardware, bathroom, kitchen collections, and furniture in the Hong Kong and the People’s Republic of China.

Flawless balance sheet with acceptable track record.