- Hong Kong

- /

- Construction

- /

- SEHK:586

China Conch Venture Holdings Limited's (HKG:586) Price Is Right But Growth Is Lacking After Shares Rocket 32%

China Conch Venture Holdings Limited (HKG:586) shares have continued their recent momentum with a 32% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

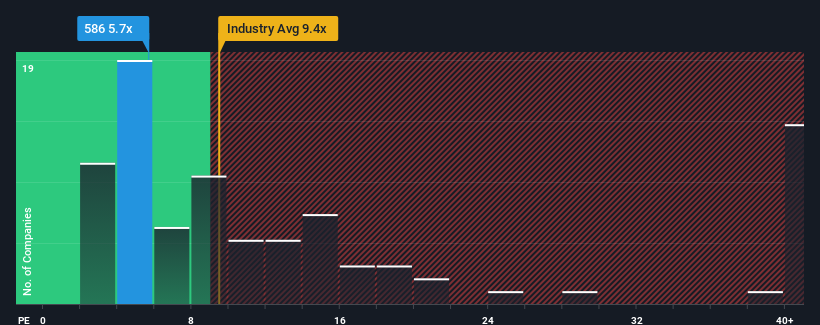

Even after such a large jump in price, China Conch Venture Holdings' price-to-earnings (or "P/E") ratio of 5.7x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 19x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

China Conch Venture Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for China Conch Venture Holdings

What Are Growth Metrics Telling Us About The Low P/E?

China Conch Venture Holdings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 65% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 5.3% each year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the market is forecast to expand by 16% each year, which is noticeably more attractive.

With this information, we can see why China Conch Venture Holdings is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

China Conch Venture Holdings' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of China Conch Venture Holdings' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with China Conch Venture Holdings (including 1 which is concerning).

You might be able to find a better investment than China Conch Venture Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:586

China Conch Venture Holdings

An investment holding company, provides various solutions for energy conservation and environmental protection in Mainland China and the Asia-Pacific.

Fair value second-rate dividend payer.

Market Insights

Community Narratives