Does L.K. Technology Holdings' (HKG:558) CEO Salary Compare Well With The Performance Of The Company?

Zhuo Ming Liu has been the CEO of L.K. Technology Holdings Limited (HKG:558) since 2017, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether L.K. Technology Holdings pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for L.K. Technology Holdings

Comparing L.K. Technology Holdings Limited's CEO Compensation With the industry

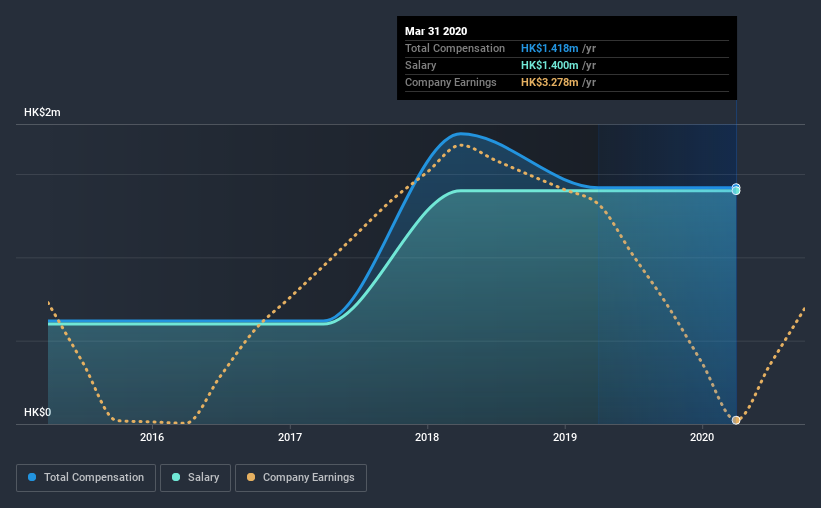

According to our data, L.K. Technology Holdings Limited has a market capitalization of HK$9.8b, and paid its CEO total annual compensation worth HK$1.4m over the year to March 2020. That is, the compensation was roughly the same as last year. In particular, the salary of HK$1.40m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from HK$7.8b to HK$25b, we found that the median CEO total compensation was HK$4.4m. This suggests that Zhuo Ming Liu is paid below the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$1.4m | HK$1.4m | 99% |

| Other | HK$18k | HK$18k | 1% |

| Total Compensation | HK$1.4m | HK$1.4m | 100% |

On an industry level, roughly 86% of total compensation represents salary and 14% is other remuneration. Investors will find it interesting that L.K. Technology Holdings pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

L.K. Technology Holdings Limited's Growth

L.K. Technology Holdings Limited has reduced its earnings per share by 22% a year over the last three years. It saw its revenue drop 3.3% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has L.K. Technology Holdings Limited Been A Good Investment?

Boasting a total shareholder return of 536% over three years, L.K. Technology Holdings Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

L.K. Technology Holdings pays its CEO a majority of compensation through a salary. As we touched on above, L.K. Technology Holdings Limited is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. And although the company is suffering from declining EPS growth over the past three years, shareholder returns remain strong. We would like to see EPS growth, but in our view CEO compensation is modest.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 3 warning signs for L.K. Technology Holdings that investors should look into moving forward.

Important note: L.K. Technology Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade L.K. Technology Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:558

L.K. Technology Holdings

An investment holding company, engages in the design, manufacture, and sale of hot and cold chamber die-casting machines in Mainland China, Hong Kong, Europe, Central America and South America, North America, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives