- Hong Kong

- /

- Construction

- /

- SEHK:406

Increases to CEO Compensation Might Be Put On Hold For Now at Yau Lee Holdings Limited (HKG:406)

Performance at Yau Lee Holdings Limited (HKG:406) has been reasonably good and CEO Ip Kuen Wong has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 25 August 2021. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Yau Lee Holdings

How Does Total Compensation For Ip Kuen Wong Compare With Other Companies In The Industry?

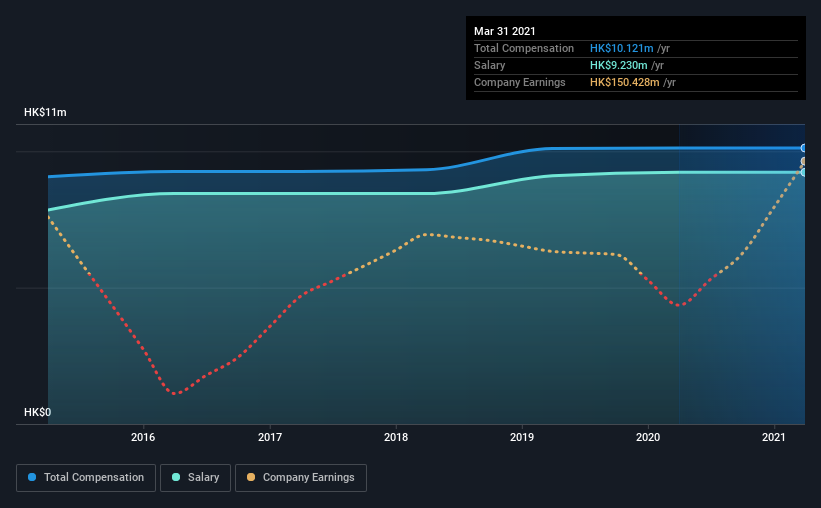

Our data indicates that Yau Lee Holdings Limited has a market capitalization of HK$635m, and total annual CEO compensation was reported as HK$10m for the year to March 2021. This was the same amount the CEO received in the prior year. In particular, the salary of HK$9.23m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$1.7m. Hence, we can conclude that Ip Kuen Wong is remunerated higher than the industry median. Furthermore, Ip Kuen Wong directly owns HK$387m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$9.2m | HK$9.2m | 91% |

| Other | HK$891k | HK$891k | 9% |

| Total Compensation | HK$10m | HK$10m | 100% |

Talking in terms of the industry, salary represented approximately 90% of total compensation out of all the companies we analyzed, while other remuneration made up 10% of the pie. Our data reveals that Yau Lee Holdings allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Yau Lee Holdings Limited's Growth

Yau Lee Holdings Limited's earnings per share (EPS) grew 42% per year over the last three years. In the last year, its revenue is up 1.5%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Yau Lee Holdings Limited Been A Good Investment?

With a total shareholder return of 9.8% over three years, Yau Lee Holdings Limited has done okay by shareholders, but there's always room for improvement. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 3 warning signs for Yau Lee Holdings that investors should look into moving forward.

Switching gears from Yau Lee Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:406

Yau Lee Holdings

An investment holding company, engages in the construction business in Hong Kong and internationally.

Moderate with adequate balance sheet.

Market Insights

Community Narratives