- Hong Kong

- /

- Construction

- /

- SEHK:3996

Investors Holding Back On China Energy Engineering Corporation Limited (HKG:3996)

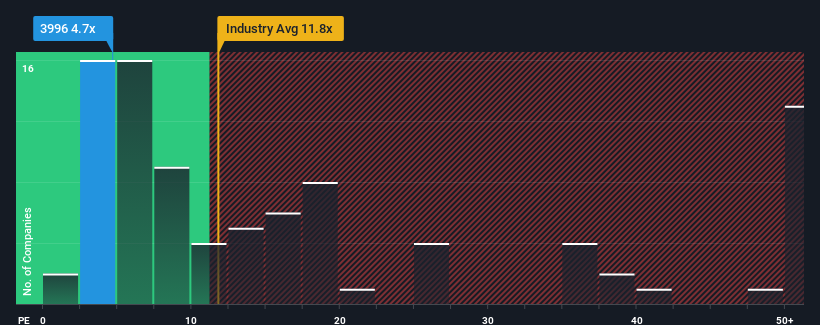

China Energy Engineering Corporation Limited's (HKG:3996) price-to-earnings (or "P/E") ratio of 4.7x might make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 11x and even P/E's above 22x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

We've discovered 1 warning sign about China Energy Engineering. View them for free.With earnings growth that's superior to most other companies of late, China Energy Engineering has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for China Energy Engineering

How Is China Energy Engineering's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as China Energy Engineering's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 5.6%. The latest three year period has also seen a 6.0% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 21% during the coming year according to the sole analyst following the company. With the market only predicted to deliver 18%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that China Energy Engineering's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On China Energy Engineering's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that China Energy Engineering currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 1 warning sign for China Energy Engineering that you should be aware of.

If you're unsure about the strength of China Energy Engineering's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3996

China Energy Engineering

Provides solutions and services in energy power and infrastructure sectors in the People’s Republic of China and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives