- Hong Kong

- /

- Construction

- /

- SEHK:3996

China Energy Engineering Corporation Limited (HKG:3996) Held Back By Insufficient Growth Even After Shares Climb 32%

China Energy Engineering Corporation Limited (HKG:3996) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

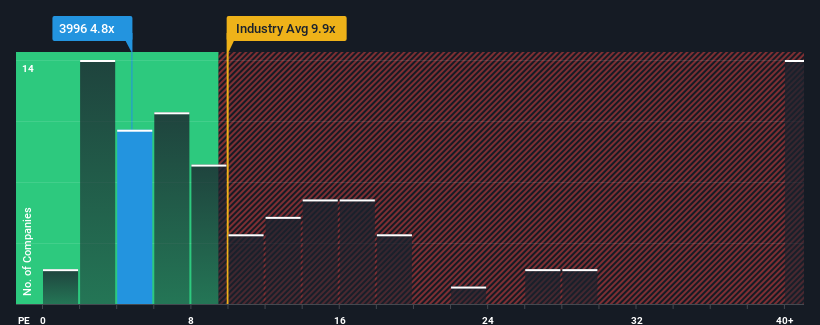

Although its price has surged higher, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 11x, you may still consider China Energy Engineering as a highly attractive investment with its 4.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

We'd have to say that with no tangible growth over the last year, China Energy Engineering's earnings have been unimpressive. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for China Energy Engineering

How Is China Energy Engineering's Growth Trending?

In order to justify its P/E ratio, China Energy Engineering would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 1.4% decline in EPS over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 22% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that China Energy Engineering is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On China Energy Engineering's P/E

Shares in China Energy Engineering are going to need a lot more upward momentum to get the company's P/E out of its slump. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of China Energy Engineering revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for China Energy Engineering that you should be aware of.

Of course, you might also be able to find a better stock than China Energy Engineering. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3996

China Energy Engineering

Provides solutions and services in energy power and infrastructure sectors in the People’s Republic of China and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives