- Austria

- /

- Construction

- /

- WBAG:STR

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, investors are witnessing fluctuations in major indices, with growth stocks lagging behind their value counterparts. Amid these dynamic conditions, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to balance volatility with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.87% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.92% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Globeride (TSE:7990) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.39% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.11% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

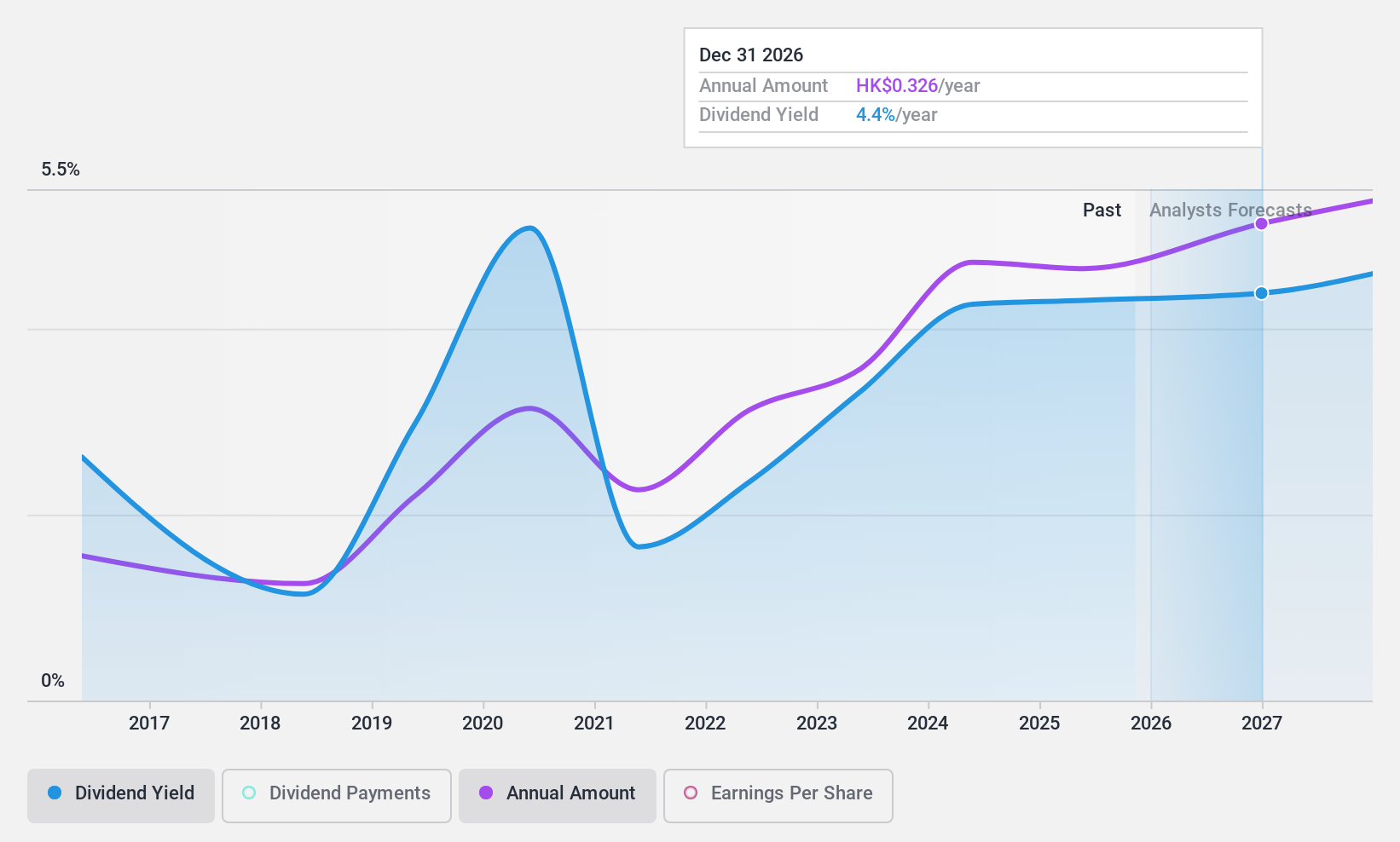

CIMC Enric Holdings (SEHK:3899)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIMC Enric Holdings Limited offers transportation, storage, and processing equipment and services for the clean energy, chemicals, environmental, and liquid food sectors globally, with a market cap of HK$14.12 billion.

Operations: CIMC Enric Holdings Limited generates revenue from its key segments, including CN¥16.49 billion from Clean Energy, CN¥4.59 billion from Liquid Food, and CN¥3.31 billion from Chemical and Environmental sectors.

Dividend Yield: 4.2%

CIMC Enric Holdings' dividends are covered by earnings and cash flows, with payout ratios of 52.8% and 62.6%, respectively, indicating sustainability. However, dividend payments have been volatile over the past decade and yield is lower at 4.22% compared to top Hong Kong payers. Recent strategic projects like the hydrogen and LNG co-production venture align with China's carbon reduction goals, potentially enhancing long-term financial stability despite recent earnings decline (net income: ¥486 million).

- Take a closer look at CIMC Enric Holdings' potential here in our dividend report.

- Upon reviewing our latest valuation report, CIMC Enric Holdings' share price might be too optimistic.

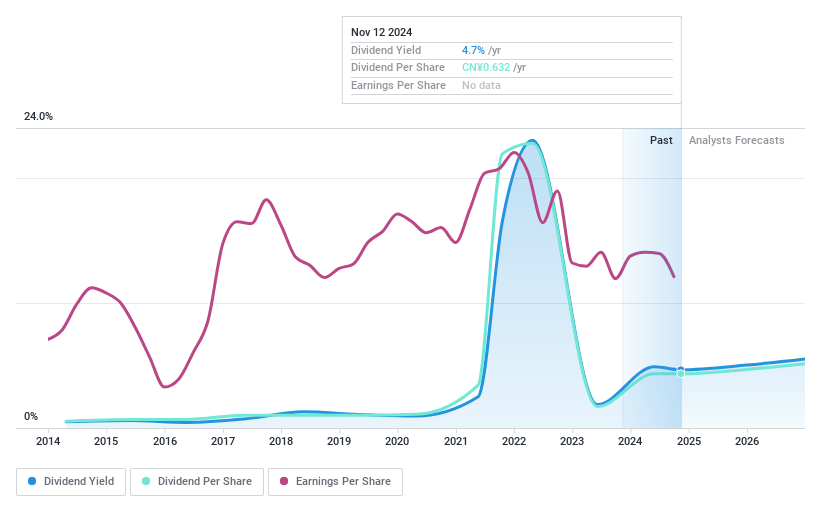

Ningbo Huaxiang Electronic (SZSE:002048)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ningbo Huaxiang Electronic Co., Ltd. designs, develops, produces, and sells auto parts both in China and internationally with a market cap of CN¥10.90 billion.

Operations: Ningbo Huaxiang Electronic Co., Ltd. generates revenue of CN¥24.97 billion from its automobile accessories segment.

Dividend Yield: 4.7%

Ningbo Huaxiang Electronic's dividend yield of 4.66% ranks in the top 25% of CN market payers, yet its dividends have been unreliable and volatile over the past decade. Despite a reasonable payout ratio of 56.9%, dividends are not well covered by free cash flow, with a high cash payout ratio of 264.8%. The company's price-to-earnings ratio stands at an attractive 12x compared to the broader market's 35.6x, suggesting relative value appeal despite recent net income decline to CNY 716.76 million for nine months ending September 2024 from CNY 839.48 million last year.

- Unlock comprehensive insights into our analysis of Ningbo Huaxiang Electronic stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ningbo Huaxiang Electronic shares in the market.

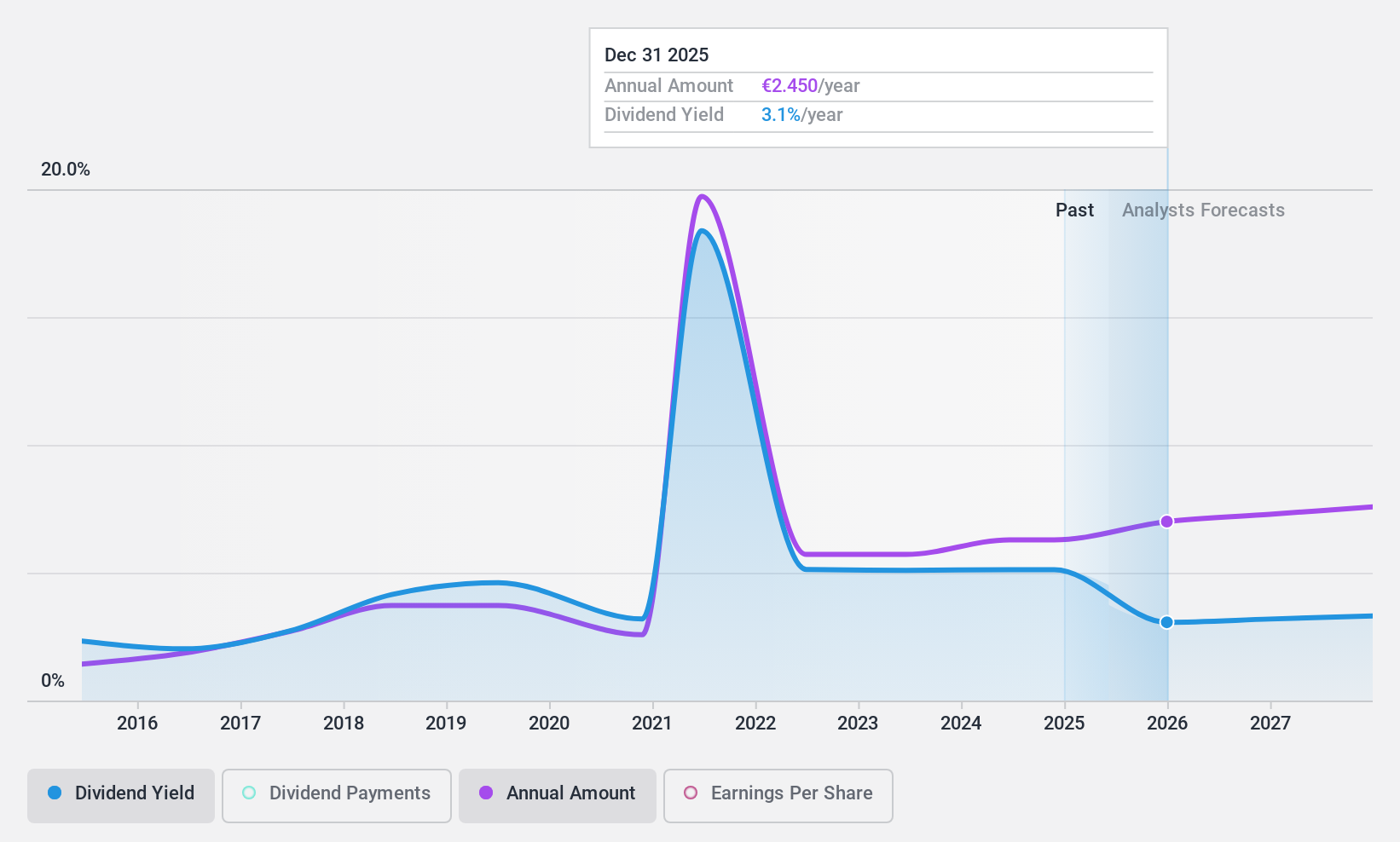

Strabag (WBAG:STR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Strabag SE is a global construction company with a market cap of €4.45 billion.

Operations: Strabag SE generates its revenue from three main segments: North + West (€7.30 billion), South + East (€7.53 billion), and International + Special Divisions (€2.88 billion).

Dividend Yield: 5.7%

Strabag's dividend payments have been volatile and unreliable over the past decade, despite a low payout ratio of 35.4% and cash payout ratio of 39%, indicating dividends are well covered by earnings and cash flows. Trading at 54.6% below its estimated fair value suggests potential undervaluation compared to peers. Recent half-year results show net income growth to €91.51 million from €74.14 million last year, although sales slightly declined to €7.46 billion from €7.69 billion.

- Navigate through the intricacies of Strabag with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Strabag's share price might be too pessimistic.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 1928 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:STR

Flawless balance sheet with solid track record and pays a dividend.