Exploring 3 Undervalued Small Caps With Insider Action In The Asian Market

Reviewed by Simply Wall St

As global markets navigate a complex landscape of trade negotiations and economic uncertainties, small-cap stocks in Asia have shown resilience, with indices like the S&P MidCap 400 and Russell 2000 posting gains despite broader market fluctuations. In this environment, identifying promising small-cap opportunities often involves looking at companies where insider activity suggests confidence in their potential to capitalize on emerging trends and adapt to shifting economic conditions.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.8x | 1.1x | 35.54% | ★★★★★★ |

| Atturra | 30.1x | 1.2x | 33.42% | ★★★★★☆ |

| Hansen Technologies | 287.7x | 2.8x | 23.94% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 46.99% | ★★★★★☆ |

| Puregold Price Club | 9.0x | 0.4x | 28.35% | ★★★★☆☆ |

| Dicker Data | 20.0x | 0.7x | -41.50% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.6x | 43.30% | ★★★★☆☆ |

| Smart Parking | 72.6x | 6.4x | 46.90% | ★★★☆☆☆ |

| Integral Diagnostics | 165.7x | 1.9x | 41.22% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 11.7x | 21.40% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Tabcorp Holdings (ASX:TAH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Tabcorp Holdings is an Australian company primarily engaged in the wagering and media industry, with additional operations in integrity services, and has a market capitalization of approximately A$4.50 billion.

Operations: The company's primary revenue streams are derived from Wagering and Media, which significantly surpasses its Integrity Services segment. Over the years, it has experienced fluctuations in net income margin, with recent periods showing negative margins. The gross profit margin consistently stands at 100%, indicating that all recorded costs of goods sold are negligible or not reported. Operating expenses include significant allocations to sales and marketing as well as general and administrative activities.

PE: -2.3x

Tabcorp Holdings, a smaller player in the Asian market, recently reported a turnaround with sales reaching A$1.33 billion for the half-year ending December 2024, up from A$1.21 billion a year prior. Net income swung to A$25 million from a significant loss previously. Insider confidence is evident as insiders have shown interest through recent share purchases. Despite dropping from the FTSE All-World Index in March 2025, earnings are projected to grow at an impressive rate of 96% annually, suggesting potential future growth despite reliance on external borrowing for funding.

- Get an in-depth perspective on Tabcorp Holdings' performance by reading our valuation report here.

Explore historical data to track Tabcorp Holdings' performance over time in our Past section.

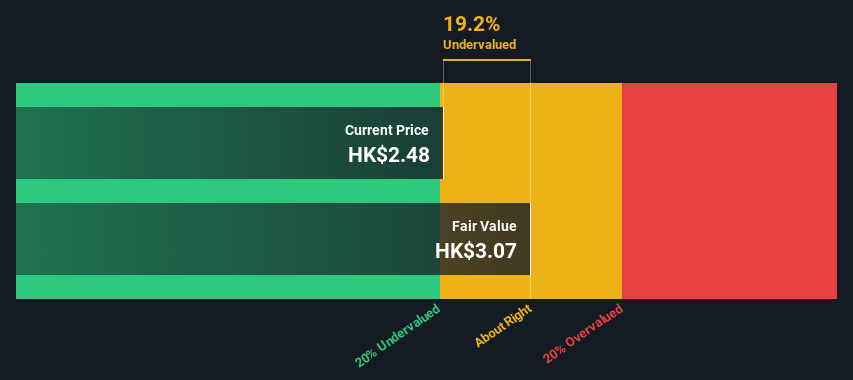

China Risun Group (SEHK:1907)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Risun Group is engaged in the manufacturing of refined chemicals and coke and coking chemicals, alongside trading and operation management services, with a market capitalization of CN¥10.2 billion.

Operations: The company generates revenue primarily from refined chemicals and coke manufacturing, with significant contributions from trading and operation management. Over recent periods, the gross profit margin has shown fluctuations, reaching 7.34% by the end of 2024. Operating expenses include sales and marketing along with general and administrative costs, which have been increasing over time.

PE: 507.3x

China Risun Group, a small company in Asia, is catching attention due to insider confidence shown by Xuegang Yang's purchase of 5.35 million shares valued at CNY 15.25 million between 2024 and early 2025. Despite a challenging year with net income dropping to CNY 20.13 million from CNY 860.81 million, they announced a special dividend of RMB 96.45 million for their anniversary celebration, indicating potential shareholder value focus amidst financial hurdles like low profit margins and high-risk funding sources.

- Click here and access our complete valuation analysis report to understand the dynamics of China Risun Group.

Understand China Risun Group's track record by examining our Past report.

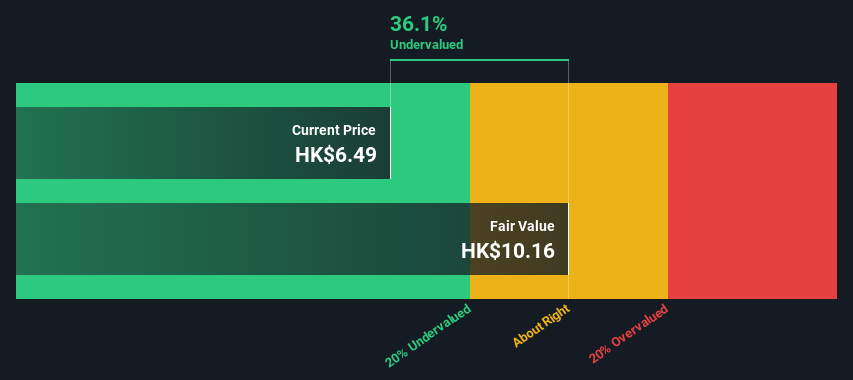

CIMC Enric Holdings (SEHK:3899)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: CIMC Enric Holdings is a company engaged in the design, engineering, and manufacturing of equipment and solutions for the clean energy, chemical and environmental, and liquid food industries, with a market capitalization of CN¥13.36 billion.

Operations: The company generates revenue primarily from Clean Energy, Liquid Food, and Chemical and Environmental segments. Over recent periods, the gross profit margin has shown a varied trend, reaching 17.35% as of December 2022 but declining to 14.36% by June 2024. Operating expenses have consistently included significant allocations for General & Administrative and Sales & Marketing activities.

PE: 10.9x

CIMC Enric Holdings, a player in the hydrogen storage sector, is capturing attention with its recent strides. Their joint venture, CIMC-Hexagon, has begun delivering Type IV high-pressure hydrogen cylinders to Europe and is pursuing Chinese certification to capitalize on local demand. Despite external borrowing risks, projected annual earnings growth of 15.52% adds optimism. Insider confidence is evident as Non-Executive Chairman Xiang Gao acquired 500,000 shares for CNY 2.89 million in March 2025, signaling potential value recognition within the company’s strategic initiatives and market positioning.

- Take a closer look at CIMC Enric Holdings' potential here in our valuation report.

Examine CIMC Enric Holdings' past performance report to understand how it has performed in the past.

Make It Happen

- Investigate our full lineup of 62 Undervalued Asian Small Caps With Insider Buying right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1907

China Risun Group

Produces, sells, and distributes coke, coking chemicals, and refined chemicals in the People’s Republic of China.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives