3 SEHK Stocks Estimated To Be Priced At A Discount Of 15.4% To 47.4%

Reviewed by Simply Wall St

As global markets experience shifts, with Chinese equities recently facing declines and the Hang Seng Index dropping significantly, investors are keenly observing opportunities within the Hong Kong market. In this context of fluctuating indices and economic adjustments, identifying undervalued stocks can be a strategic approach for those looking to capitalize on potential discounts in pricing.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$33.85 | HK$63.74 | 46.9% |

| Giant Biogene Holding (SEHK:2367) | HK$52.25 | HK$96.94 | 46.1% |

| Laopu Gold (SEHK:6181) | HK$163.00 | HK$310.07 | 47.4% |

| Kuaishou Technology (SEHK:1024) | HK$49.60 | HK$88.97 | 44.3% |

| Yadea Group Holdings (SEHK:1585) | HK$13.18 | HK$23.33 | 43.5% |

| CSC Financial (SEHK:6066) | HK$9.46 | HK$17.71 | 46.6% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$10.76 | HK$19.60 | 45.1% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$31.30 | HK$56.08 | 44.2% |

| AK Medical Holdings (SEHK:1789) | HK$4.66 | HK$8.36 | 44.2% |

| DPC Dash (SEHK:1405) | HK$75.65 | HK$133.78 | 43.5% |

Let's review some notable picks from our screened stocks.

Zhaojin Mining Industry (SEHK:1818)

Overview: Zhaojin Mining Industry Company Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and silver products in the People’s Republic of China with a market cap of HK$45.86 billion.

Operations: The company's revenue segments include exploration, mining, processing, smelting, and sale of gold and silver products in the People’s Republic of China.

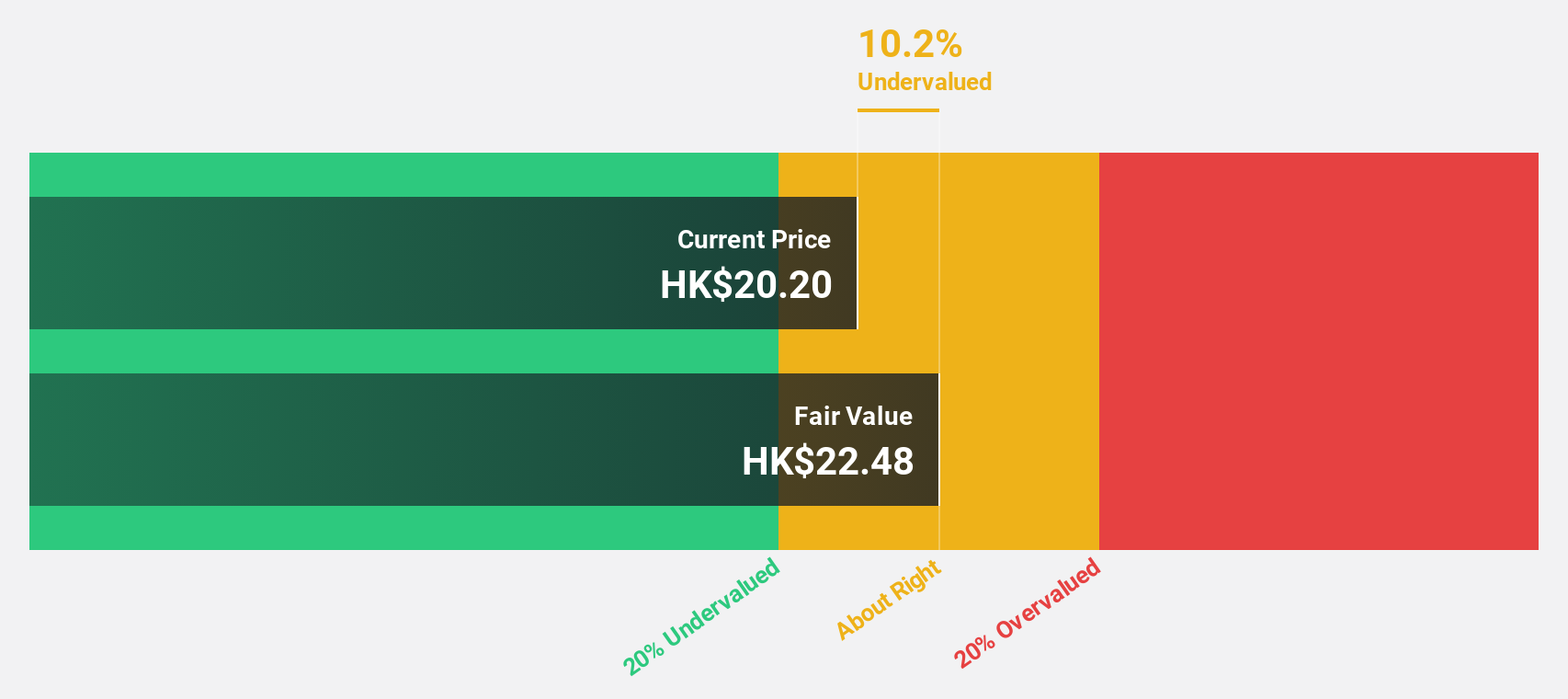

Estimated Discount To Fair Value: 36.5%

Zhaojin Mining Industry appears undervalued based on cash flow analysis, trading at HK$13.48 against a fair value estimate of HK$21.23, a 36.5% discount. Recent earnings show strong growth with net income rising to CNY 880.64 million for the first nine months of 2024 from CNY 365.31 million the previous year, and sales increasing to CNY 8.09 billion from CNY 6.38 billion, reflecting robust operational performance despite past shareholder dilution concerns.

- According our earnings growth report, there's an indication that Zhaojin Mining Industry might be ready to expand.

- Dive into the specifics of Zhaojin Mining Industry here with our thorough financial health report.

CIMC Enric Holdings (SEHK:3899)

Overview: CIMC Enric Holdings Limited offers transportation, storage, and processing equipment and services for the clean energy, chemicals, environmental, and liquid food sectors globally with a market cap of HK$14.04 billion.

Operations: The company's revenue segments are comprised of CN¥16.49 billion from Clean Energy, CN¥4.59 billion from Liquid Food, and CN¥3.31 billion from Chemical and Environmental sectors.

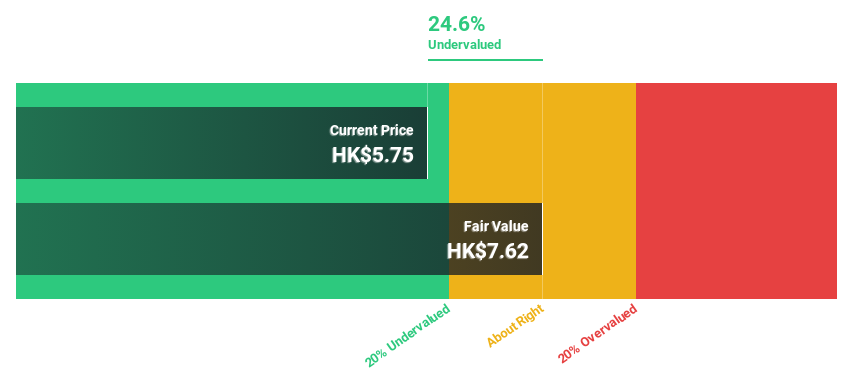

Estimated Discount To Fair Value: 15.4%

CIMC Enric Holdings is trading at HK$6.92, below its estimated fair value of HK$8.18, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 20.7% per year, outpacing the Hong Kong market's growth rate. Recent strategic initiatives in hydrogen and LNG production align with China's carbon reduction goals, although recent earnings showed a decrease in net income to CNY 486.14 million from CNY 568.67 million year-on-year.

- The analysis detailed in our CIMC Enric Holdings growth report hints at robust future financial performance.

- Get an in-depth perspective on CIMC Enric Holdings' balance sheet by reading our health report here.

Laopu Gold (SEHK:6181)

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market capitalization of approximately HK$27.44 billion.

Operations: The company's revenue primarily comes from its Jewelry & Watches segment, which generated CN¥5.28 billion.

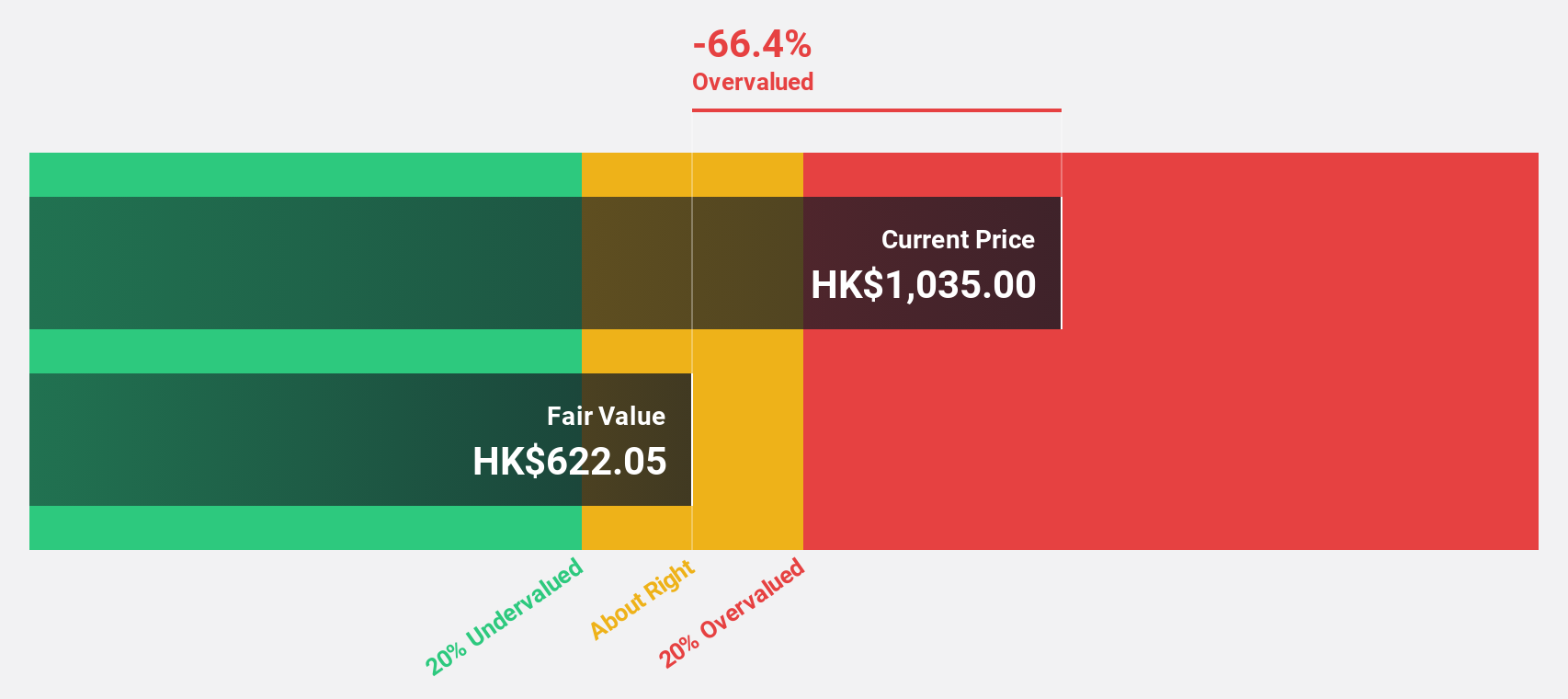

Estimated Discount To Fair Value: 47.4%

Laopu Gold is trading at HK$163, significantly below its estimated fair value of HK$310.07, highlighting potential undervaluation based on cash flows. The company reported robust financials for the first half of 2024 with sales reaching CNY 3.52 billion and net income at CNY 587.81 million, showing substantial growth from the previous year. Earnings are forecast to grow annually by 33.2%, surpassing market averages and supported by high-quality earnings despite recent amendments to its Articles of Association.

- Our growth report here indicates Laopu Gold may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Laopu Gold's balance sheet health report.

Make It Happen

- Get an in-depth perspective on all 36 Undervalued SEHK Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3899

CIMC Enric Holdings

Provides transportation, storage, and processing equipment and services for the clean energy, chemicals, environmental, and liquid food sectors worldwide.

Excellent balance sheet with reasonable growth potential and pays a dividend.