Zhuzhou CRRC Times Electric's (HKG:3898) Shareholders Will Receive A Bigger Dividend Than Last Year

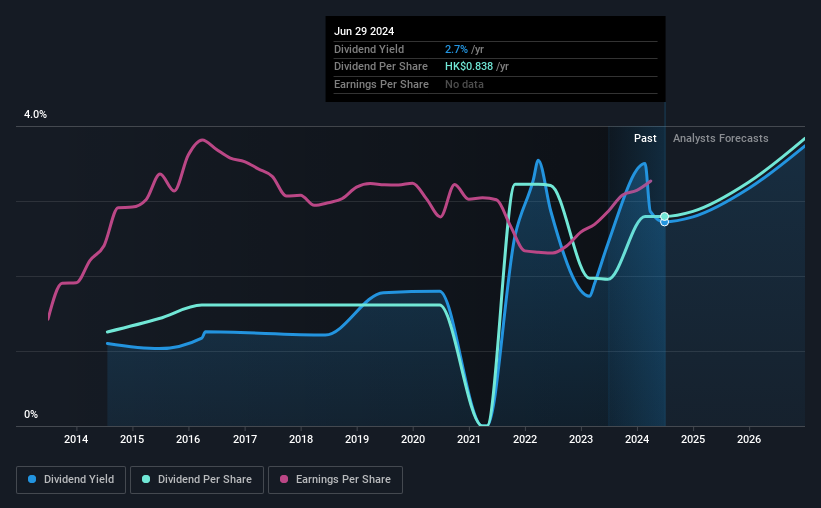

Zhuzhou CRRC Times Electric Co., Ltd.'s (HKG:3898) dividend will be increasing from last year's payment of the same period to CN¥0.855 on 8th of August. Based on this payment, the dividend yield for the company will be 2.7%, which is fairly typical for the industry.

View our latest analysis for Zhuzhou CRRC Times Electric

Zhuzhou CRRC Times Electric's Payment Has Solid Earnings Coverage

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Prior to this announcement, Zhuzhou CRRC Times Electric's dividend was only 34% of earnings, however it was paying out 162% of free cash flows. The business might be trying to strike a balance between returning cash to shareholders and reinvesting back into the business, but this high of a payout ratio could definitely force the dividend to be cut if the company runs into a bit of a tough spot.

Over the next year, EPS is forecast to expand by 41.6%. If the dividend continues on this path, the payout ratio could be 28% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the dividend has gone from CN¥0.35 total annually to CN¥0.78. This implies that the company grew its distributions at a yearly rate of about 8.3% over that duration. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Zhuzhou CRRC Times Electric might have put its house in order since then, but we remain cautious.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Although it's important to note that Zhuzhou CRRC Times Electric's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. If Zhuzhou CRRC Times Electric is struggling to find viable investments, it always has the option to increase its payout ratio to pay more to shareholders.

Our Thoughts On Zhuzhou CRRC Times Electric's Dividend

Overall, we always like to see the dividend being raised, but we don't think Zhuzhou CRRC Times Electric will make a great income stock. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Earnings growth generally bodes well for the future value of company dividend payments. See if the 23 Zhuzhou CRRC Times Electric analysts we track are forecasting continued growth with our free report on analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou CRRC Times Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3898

Zhuzhou CRRC Times Electric

Engages in the manufacture and sale of propulsion and control systems to rolling stock industry in Mainland China and internationally.

Flawless balance sheet with solid track record.