Sinotruk (Hong Kong) Limited (HKG:3808) Stocks Shoot Up 29% But Its P/E Still Looks Reasonable

The Sinotruk (Hong Kong) Limited (HKG:3808) share price has done very well over the last month, posting an excellent gain of 29%. The last 30 days bring the annual gain to a very sharp 65%.

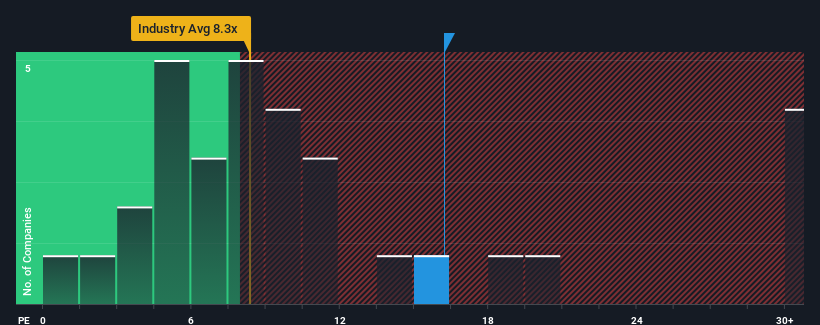

Following the firm bounce in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 8x, you may consider Sinotruk (Hong Kong) as a stock to avoid entirely with its 16.2x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Sinotruk (Hong Kong) has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Sinotruk (Hong Kong)

Is There Enough Growth For Sinotruk (Hong Kong)?

Sinotruk (Hong Kong)'s P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 46% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 26% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 30% per year over the next three years. With the market only predicted to deliver 16% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Sinotruk (Hong Kong)'s P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Sinotruk (Hong Kong)'s P/E

Shares in Sinotruk (Hong Kong) have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sinotruk (Hong Kong) maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Sinotruk (Hong Kong) with six simple checks on some of these key factors.

You might be able to find a better investment than Sinotruk (Hong Kong). If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3808

Sinotruk (Hong Kong)

An investment holding company, engages in the research, development, manufacture, and sale of heavy-duty trucks (HDT), medium-heavy duty trucks, light duty trucks (LDT), buses, and related parts and components in Mainland China and internationally.

Excellent balance sheet with proven track record and pays a dividend.