January 2025's Top Growth Companies With High Insider Confidence

Reviewed by Simply Wall St

As we step into January 2025, global markets have been navigating a complex landscape marked by fluctuating consumer confidence and mixed economic indicators. Despite these challenges, major indices like the Nasdaq Composite have shown resilience with moderate gains, highlighting the potential of growth stocks even amid broader economic uncertainties. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong internal confidence in their long-term prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

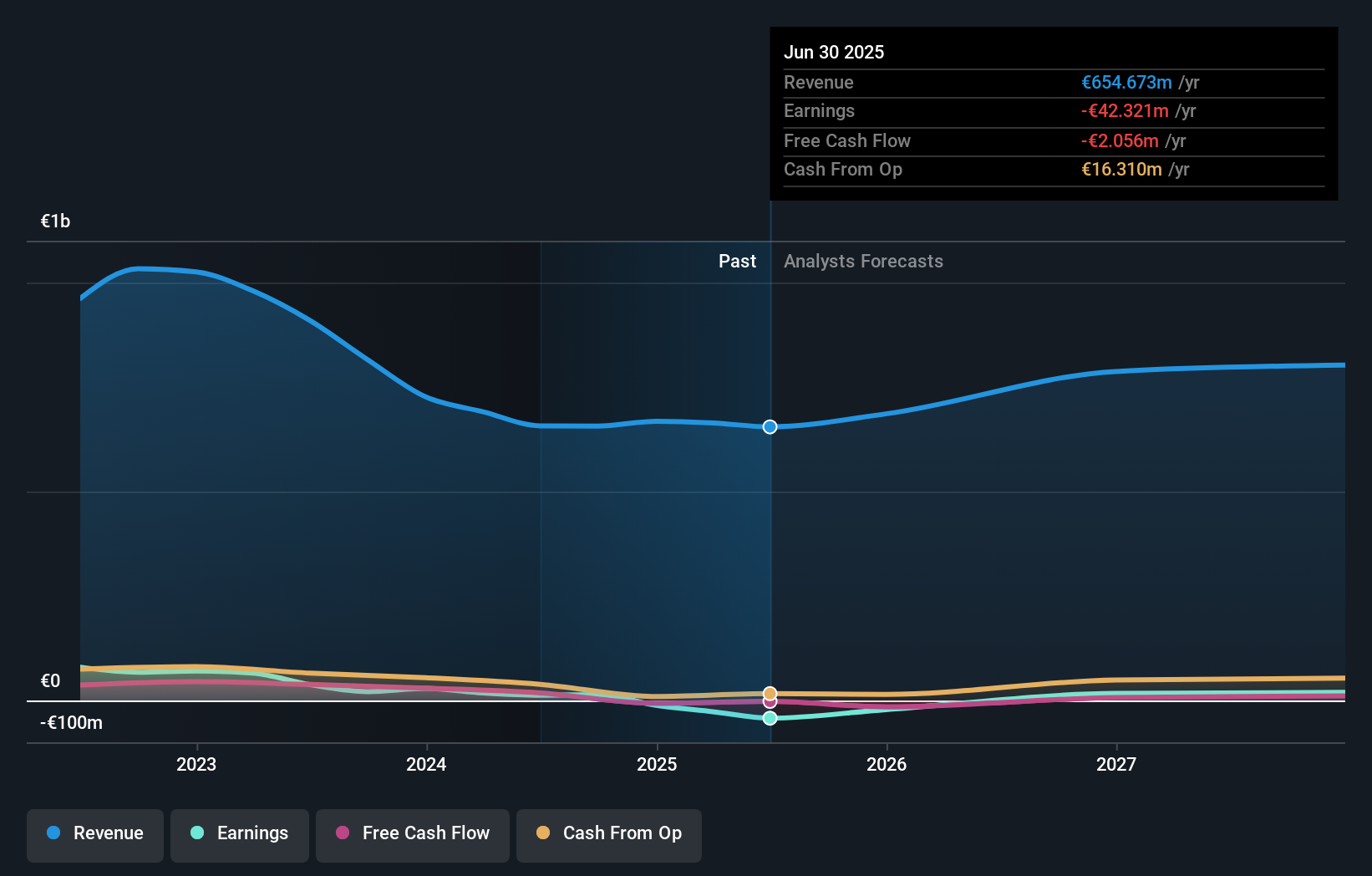

Ercros (BME:ECR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ercros, S.A. operates in Spain, manufacturing and selling basic chemicals, intermediate chemicals, and pharmaceuticals with a market cap of €323.68 million.

Operations: The company's revenue is segmented into Chlorine Derivatives (€375.76 million), Intermediate Chemicals (€193.57 million), and Pharmaceuticals (€63.57 million).

Insider Ownership: 15.7%

Revenue Growth Forecast: 10.4% p.a.

Ercros is trading at 14.8% below its estimated fair value, indicating potential undervaluation. Despite a recent net loss of €7.8 million for the nine months ending September 2024, Ercros's earnings are forecast to grow significantly at 48.5% annually, outpacing the Spanish market's growth rate. However, its Return on Equity is projected to be low in three years (6.7%), and large one-off items impact financial results stability.

- Unlock comprehensive insights into our analysis of Ercros stock in this growth report.

- Our expertly prepared valuation report Ercros implies its share price may be too high.

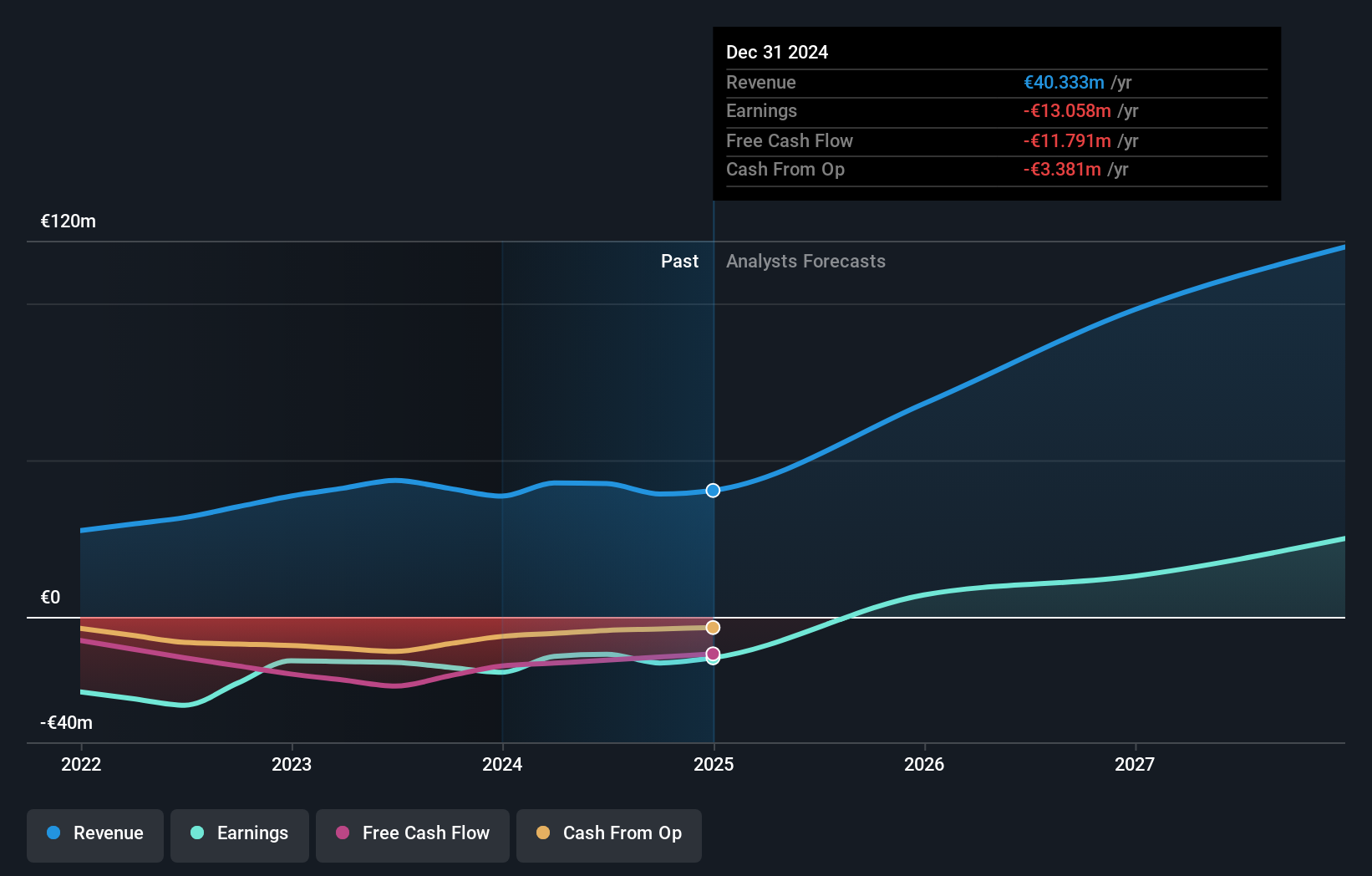

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union with a market cap of €251.24 million.

Operations: The company generates revenue from its Software & Programming segment, amounting to €42.50 million.

Insider Ownership: 35.7%

Revenue Growth Forecast: 22.1% p.a.

MotorK's revenue is forecast to grow at 22.1% annually, surpassing the Dutch market's growth rate. The company revised its Committed Annual Recurring Revenue target to €45 million-€50 million for 2024, contingent on closing major deals amid extended sales cycles. While MotorK aims for profitability within three years, past shareholder dilution and less than a year's cash runway present challenges. Despite these hurdles, earnings are expected to grow significantly at 108.44% per year.

- Get an in-depth perspective on MotorK's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that MotorK is trading beyond its estimated value.

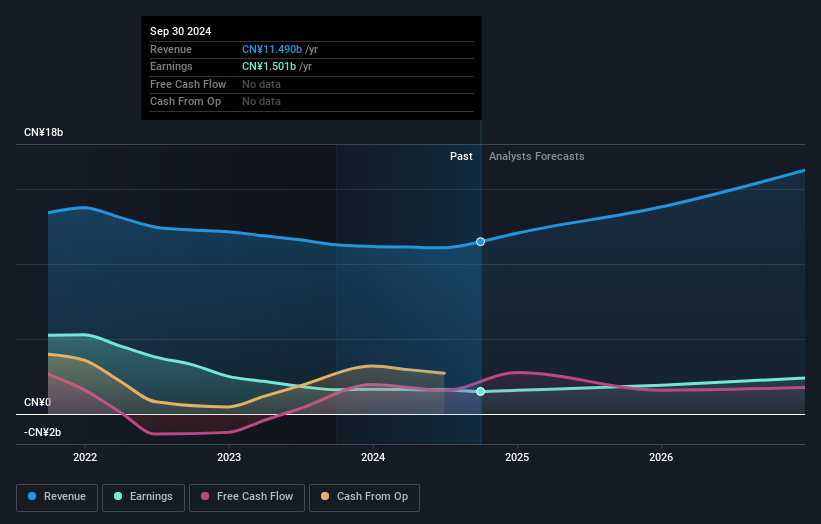

Smoore International Holdings (SEHK:6969)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Smoore International Holdings Limited is an investment holding company that provides vaping technology solutions, with a market capitalization of approximately HK$80.34 billion.

Operations: Smoore International Holdings Limited generates revenue primarily from its vaping technology solutions, with reported figures in millions of CN¥.

Insider Ownership: 39.1%

Revenue Growth Forecast: 15.4% p.a.

Smoore International Holdings shows promising growth potential with forecasted earnings to grow significantly at 21.2% annually, outpacing the Hong Kong market average. Despite a decline in net income for Q3 2024, revenue increased to CNY 3.29 billion from CNY 2.88 billion year-over-year. The company's expected revenue growth of 15.4% annually is robust, though slower than desired high-growth rates, and its Return on Equity is projected to remain modest at 9.1%.

- Take a closer look at Smoore International Holdings' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Smoore International Holdings shares in the market.

Key Takeaways

- Click here to access our complete index of 1503 Fast Growing Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Smoore International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6969

Smoore International Holdings

An investment holding company, engages in the provision of vaping technology solutions.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives