- Hong Kong

- /

- Construction

- /

- SEHK:3728

These 4 Measures Indicate That Ching Lee Holdings (HKG:3728) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Ching Lee Holdings Limited (HKG:3728) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Ching Lee Holdings

What Is Ching Lee Holdings's Net Debt?

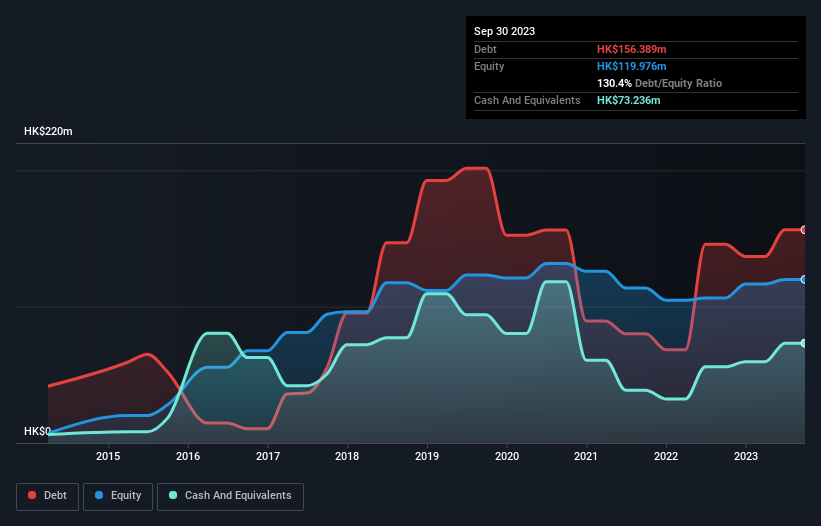

You can click the graphic below for the historical numbers, but it shows that as of September 2023 Ching Lee Holdings had HK$156.4m of debt, an increase on HK$145.7m, over one year. However, because it has a cash reserve of HK$73.2m, its net debt is less, at about HK$83.2m.

A Look At Ching Lee Holdings' Liabilities

According to the last reported balance sheet, Ching Lee Holdings had liabilities of HK$441.2m due within 12 months, and liabilities of HK$1.09m due beyond 12 months. Offsetting these obligations, it had cash of HK$73.2m as well as receivables valued at HK$389.4m due within 12 months. So it can boast HK$20.3m more liquid assets than total liabilities.

This surplus suggests that Ching Lee Holdings is using debt in a way that is appears to be both safe and conservative. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Ching Lee Holdings has a debt to EBITDA ratio of 3.2 and its EBIT covered its interest expense 5.2 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Notably, Ching Lee Holdings made a loss at the EBIT level, last year, but improved that to positive EBIT of HK$25m in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Ching Lee Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. In the last year, Ching Lee Holdings's free cash flow amounted to 43% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

When it comes to the balance sheet, the standout positive for Ching Lee Holdings was the fact that it seems able to handle its total liabilities confidently. But the other factors we noted above weren't so encouraging. For example, its net debt to EBITDA makes us a little nervous about its debt. Considering this range of data points, we think Ching Lee Holdings is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 5 warning signs for Ching Lee Holdings (of which 2 can't be ignored!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3728

Ching Lee Holdings

An investment holding company, engages in the provision of construction, consultancy, and project management services primarily in Hong Kong.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives