- Hong Kong

- /

- Industrials

- /

- SEHK:3686

Clifford Modern Living Holdings'(HKG:3686) Share Price Is Down 15% Over The Past Three Years.

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Clifford Modern Living Holdings Limited (HKG:3686) shareholders have had that experience, with the share price dropping 15% in three years, versus a market decline of about 0.4%.

Check out our latest analysis for Clifford Modern Living Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate three years of share price decline, Clifford Modern Living Holdings actually saw its earnings per share (EPS) improve by 30% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. Revenue has been pretty flat over three years, so that isn't an obvious reason shareholders would sell. So it might be worth looking at how revenue growth over time, in greater detail.

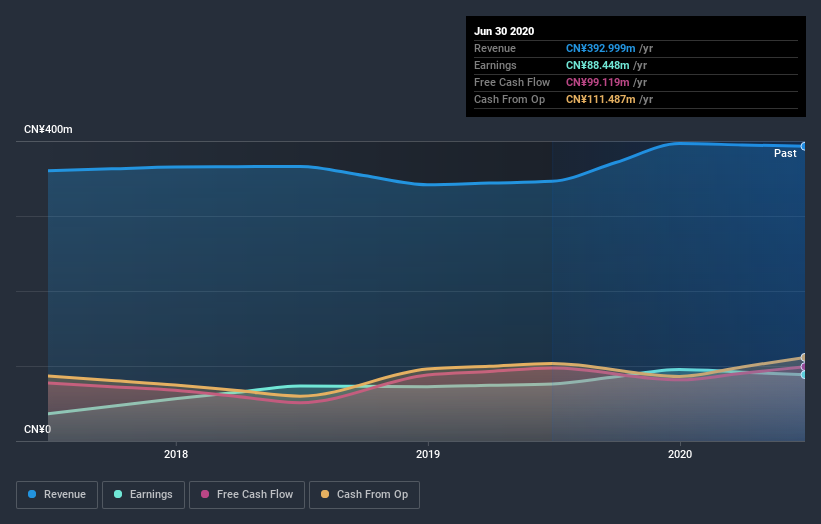

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Clifford Modern Living Holdings' earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Clifford Modern Living Holdings, it has a TSR of -5.9% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Over the last year, Clifford Modern Living Holdings shareholders took a loss of 4.8%, including dividends. In contrast the market gained about 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 1.9% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Clifford Modern Living Holdings has 2 warning signs we think you should be aware of.

We will like Clifford Modern Living Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Clifford Modern Living Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3686

Clifford Modern Living Holdings

An investment holding company, provides services to residents in developed properties under the Clifford brand name in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives