Lonking Holdings And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets experience mixed performances, with major indexes like the S&P 500 and Nasdaq Composite reaching record highs while the Russell 2000 sees a decline, investors are keenly observing economic indicators such as job growth and interest rate expectations. In this environment of varied market sentiment, identifying promising stocks can be challenging but rewarding; focusing on companies with strong fundamentals and growth potential can help enhance a portfolio's resilience.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Lonking Holdings (SEHK:3339)

Simply Wall St Value Rating: ★★★★★★

Overview: Lonking Holdings Limited is an investment holding company that manufactures and distributes construction machinery, including wheel loaders, road rollers, excavators, and forklifts in Mainland China and internationally, with a market capitalization of HK$6.33 billion.

Operations: The company generates revenue primarily from the sale of construction machinery, totaling CN¥10.16 billion.

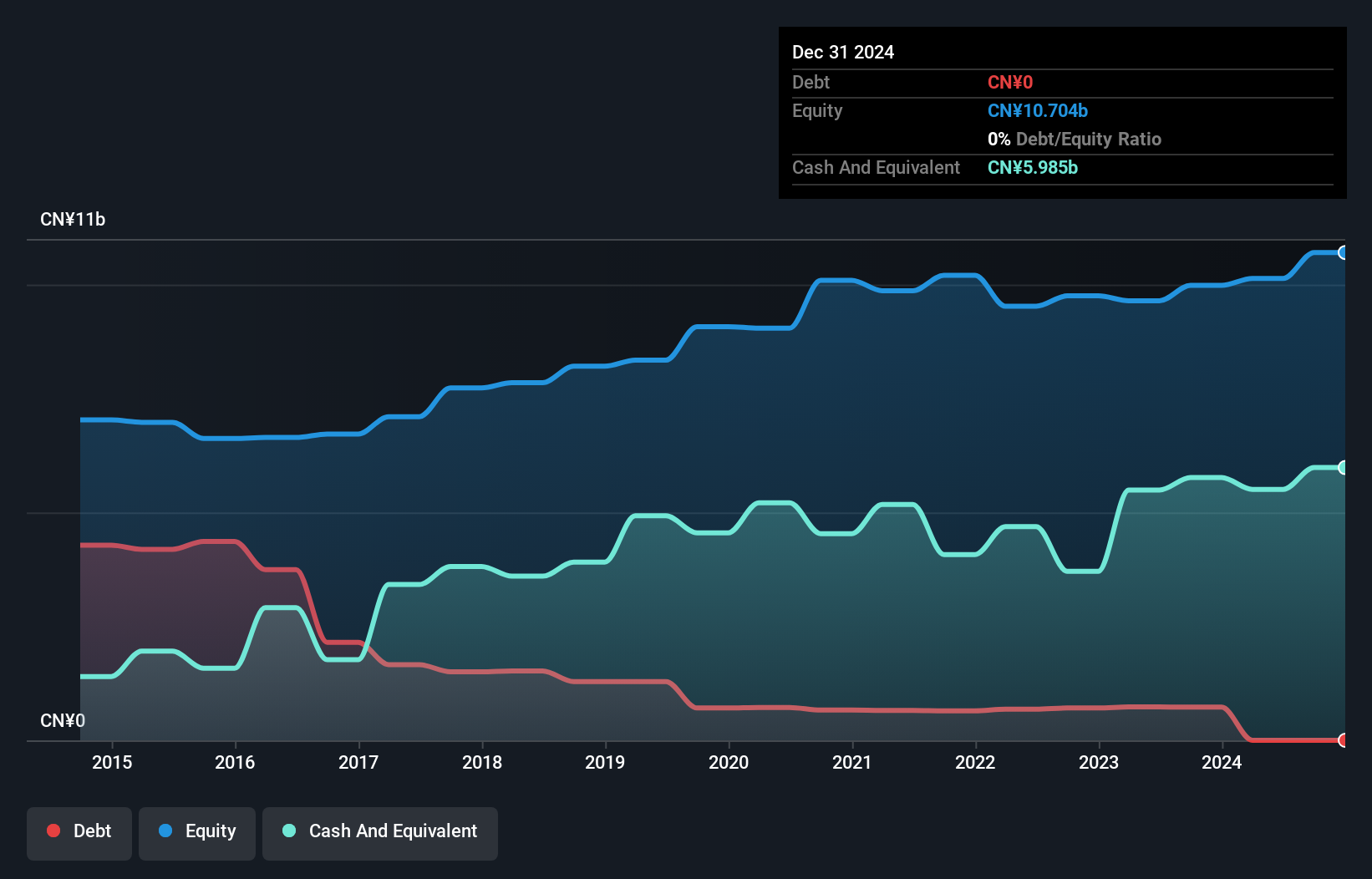

Lonking Holdings, a nimble player in the machinery sector, shows promise with earnings surging by 42% over the past year, outpacing the industry average of 7.8%. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 15.5%, signaling improved financial health. With high-quality earnings and trading at approximately 26% below estimated fair value, Lonking seems well-positioned for future growth. Its profitability suggests that cash runway isn't a concern, and positive free cash flow further underscores its robust financial standing in this competitive landscape.

- Dive into the specifics of Lonking Holdings here with our thorough health report.

Examine Lonking Holdings' past performance report to understand how it has performed in the past.

HangZhou Nbond Nonwovens (SHSE:603238)

Simply Wall St Value Rating: ★★★★★☆

Overview: HangZhou Nbond Nonwovens Co., Ltd. focuses on the research, development, production, and sale of spunlace nonwovens materials both in China and internationally, with a market cap of CN¥2.30 billion.

Operations: The company generates revenue primarily from the sale of spunlace nonwovens materials. It operates both domestically in China and internationally, contributing to its market presence.

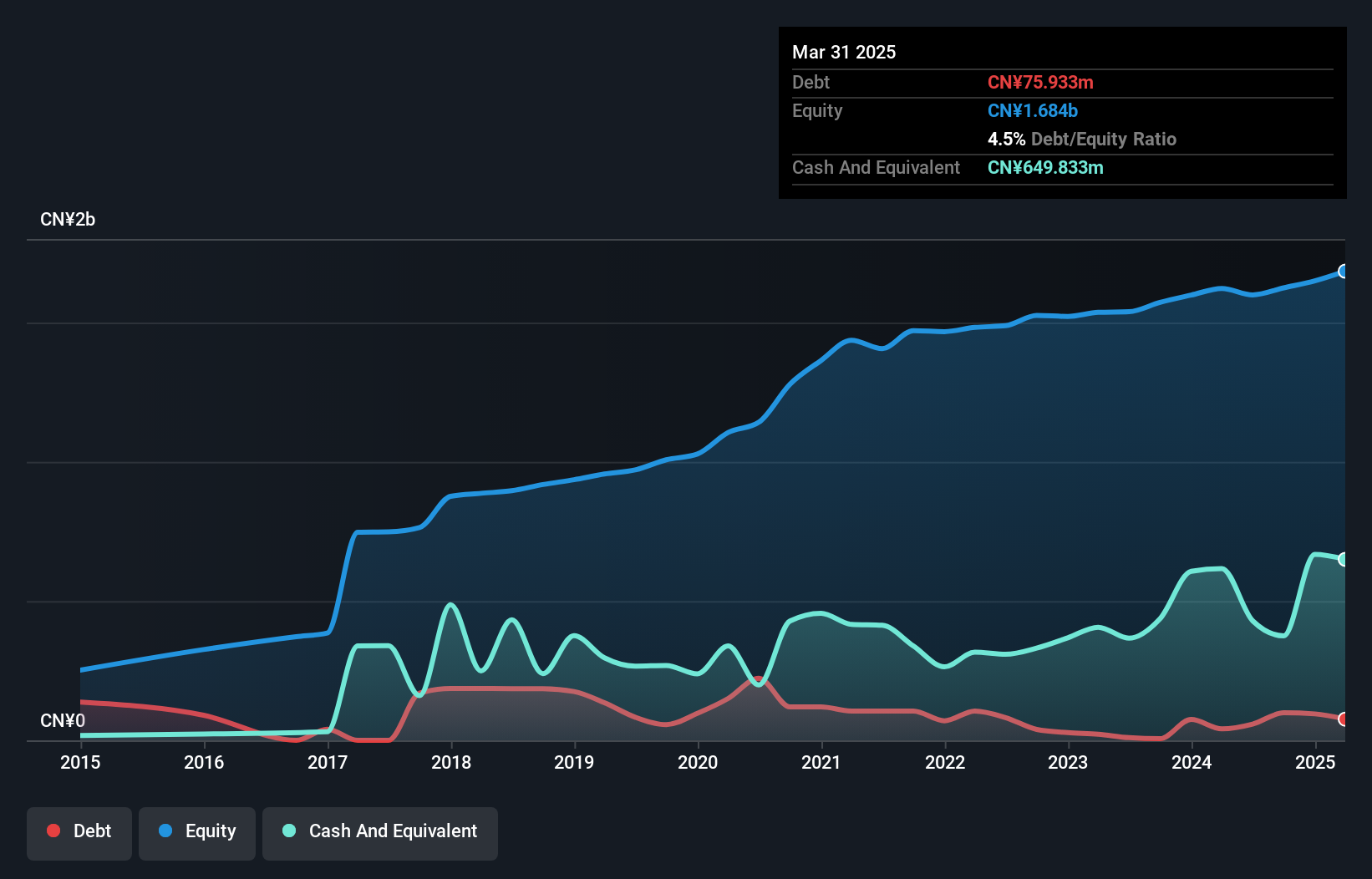

HangZhou Nbond Nonwovens showcases a promising profile with recent sales reaching CNY 1.56 billion, up from CNY 1.35 billion the previous year, reflecting robust growth. The company reported net income of CNY 69.35 million compared to last year's CNY 54.26 million, indicating improved profitability with basic earnings per share rising to CNY 0.39 from CNY 0.31. Despite an annual earnings decline of about 20% over five years, recent performance shows a significant turnaround with a remarkable earnings growth of nearly 59% in the past year alone and trading at an attractive valuation below its estimated fair value by around 18%.

- Take a closer look at HangZhou Nbond Nonwovens' potential here in our health report.

Assess HangZhou Nbond Nonwovens' past performance with our detailed historical performance reports.

Sakata Seed (TSE:1377)

Simply Wall St Value Rating: ★★★★★★

Overview: Sakata Seed Corporation is engaged in the production and sale of vegetable and flower seeds, bulbs, plants, as well as agricultural and horticultural supplies both domestically in Japan and internationally, with a market capitalization of ¥153.69 billion.

Operations: Sakata Seed's revenue primarily stems from the sale of vegetable and flower seeds, bulbs, plants, and agricultural supplies. The company's financial performance is influenced by its international operations alongside domestic sales in Japan.

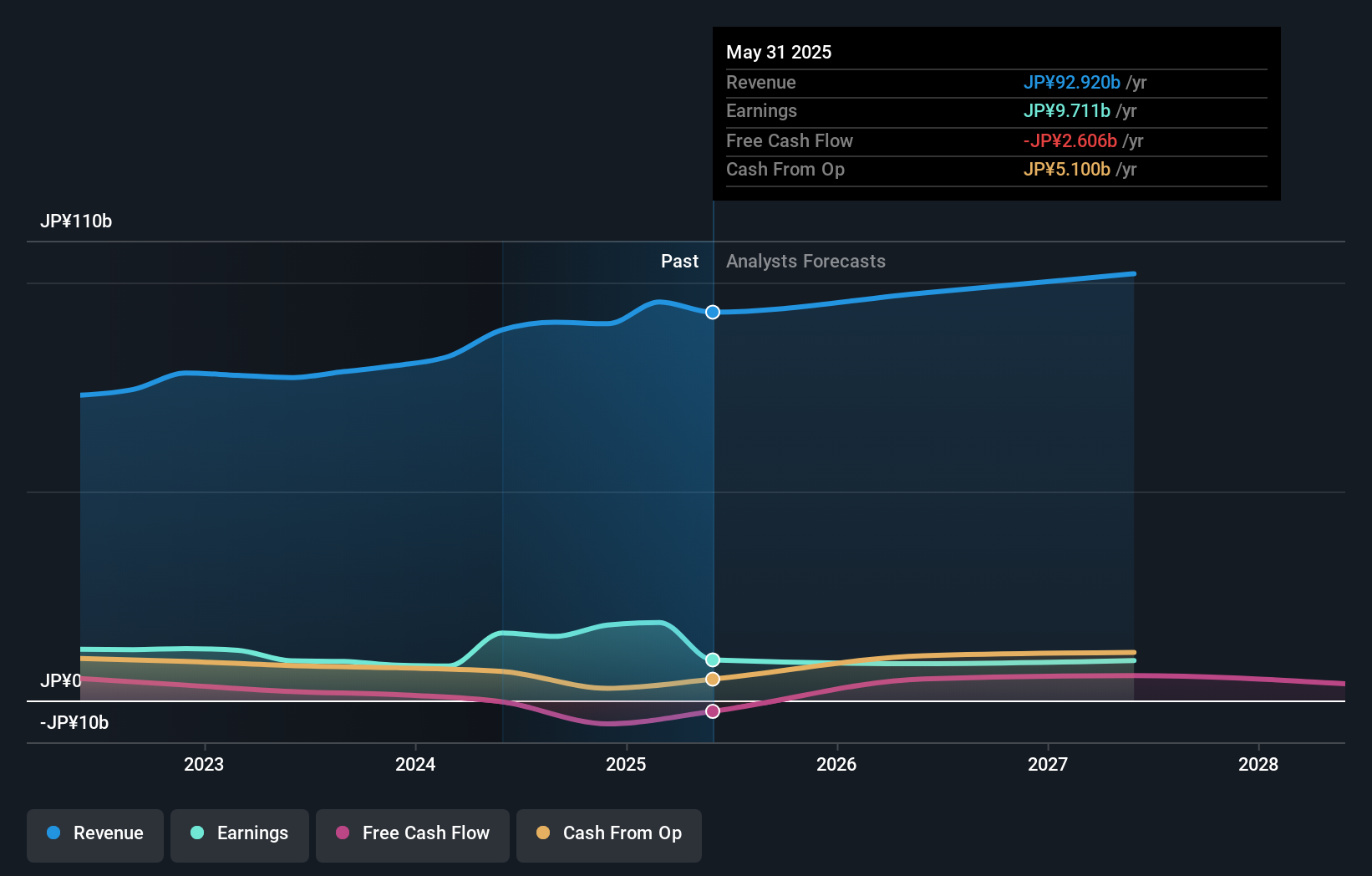

Sakata Seed, a small cap player in the food industry, has shown impressive earnings growth of 64% over the past year, outpacing the industry's 20.1%. Despite this surge, it trades at a significant discount of 40.6% below its estimated fair value. The company's debt to equity ratio has notably improved from 5.6 to 1.9 over five years, suggesting better financial health. However, recent results were influenced by a ¥11 billion one-off gain, which might not reflect ongoing performance trends accurately. Looking forward, revenues are expected to grow modestly at 4.21% annually while earnings may face challenges ahead with an anticipated decline of about 12.6% per year for three years.

- Click here and access our complete health analysis report to understand the dynamics of Sakata Seed.

Evaluate Sakata Seed's historical performance by accessing our past performance report.

Taking Advantage

- Investigate our full lineup of 4645 Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1377

Sakata Seed

Produces and sells vegetable and flower seeds, bulbs, plants, and agricultural and horticultural supplies in Japan and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives