- Hong Kong

- /

- Construction

- /

- SEHK:331

It's Unlikely That FSE Lifestyle Services Limited's (HKG:331) CEO Will See A Huge Pay Rise This Year

Under the guidance of CEO Rocky Poon, FSE Lifestyle Services Limited (HKG:331) has performed reasonably well recently. As shareholders go into the upcoming AGM on 19 November 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for FSE Lifestyle Services

Comparing FSE Lifestyle Services Limited's CEO Compensation With the industry

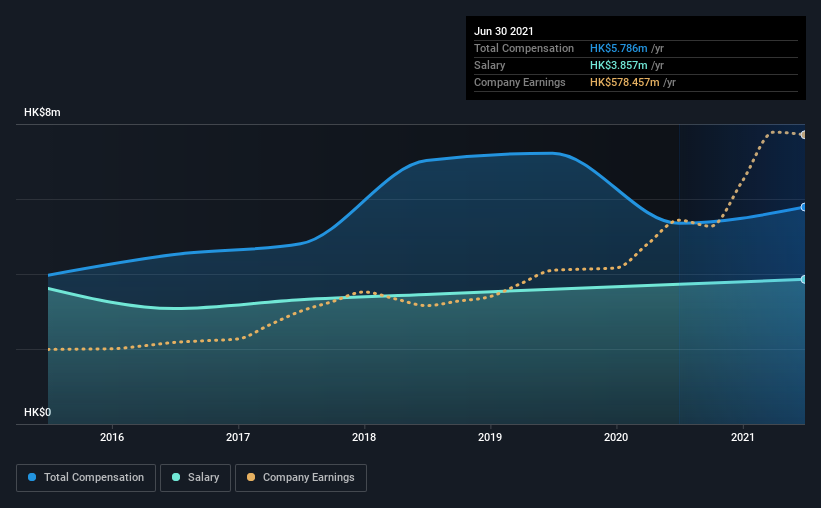

At the time of writing, our data shows that FSE Lifestyle Services Limited has a market capitalization of HK$3.0b, and reported total annual CEO compensation of HK$5.8m for the year to June 2021. That's a notable increase of 8.1% on last year. We note that the salary portion, which stands at HK$3.86m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between HK$1.6b and HK$6.2b, we discovered that the median CEO total compensation of that group was HK$2.4m. Accordingly, our analysis reveals that FSE Lifestyle Services Limited pays Rocky Poon north of the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$3.9m | HK$3.7m | 67% |

| Other | HK$1.9m | HK$1.6m | 33% |

| Total Compensation | HK$5.8m | HK$5.4m | 100% |

Speaking on an industry level, nearly 89% of total compensation represents salary, while the remainder of 11% is other remuneration. FSE Lifestyle Services sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

FSE Lifestyle Services Limited's Growth

Over the past three years, FSE Lifestyle Services Limited has seen its earnings per share (EPS) grow by 35% per year. In the last year, its revenue is up 14%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has FSE Lifestyle Services Limited Been A Good Investment?

Most shareholders would probably be pleased with FSE Lifestyle Services Limited for providing a total return of 160% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 2 warning signs for FSE Lifestyle Services that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:331

FSE Lifestyle Services

An investment holding company, provides city essential services in Hong Kong, Mainland China, and Macau.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives