Does CSSC Offshore & Marine Engineering (Group) (HKG:317) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, CSSC Offshore & Marine Engineering (Group) Company Limited (HKG:317) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for CSSC Offshore & Marine Engineering (Group)

How Much Debt Does CSSC Offshore & Marine Engineering (Group) Carry?

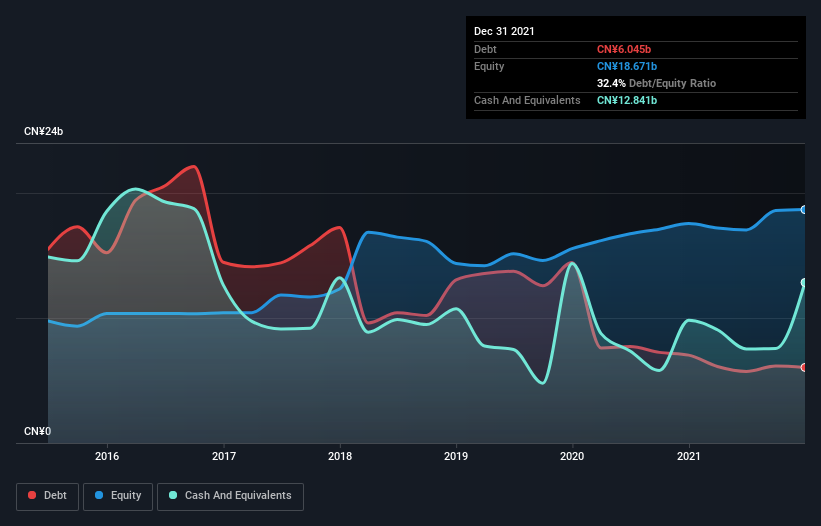

You can click the graphic below for the historical numbers, but it shows that CSSC Offshore & Marine Engineering (Group) had CN¥6.04b of debt in December 2021, down from CN¥7.03b, one year before. But it also has CN¥12.8b in cash to offset that, meaning it has CN¥6.80b net cash.

A Look At CSSC Offshore & Marine Engineering (Group)'s Liabilities

Zooming in on the latest balance sheet data, we can see that CSSC Offshore & Marine Engineering (Group) had liabilities of CN¥21.0b due within 12 months and liabilities of CN¥4.58b due beyond that. On the other hand, it had cash of CN¥12.8b and CN¥3.99b worth of receivables due within a year. So it has liabilities totalling CN¥8.76b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since CSSC Offshore & Marine Engineering (Group) has a market capitalization of CN¥14.6b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, CSSC Offshore & Marine Engineering (Group) also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is CSSC Offshore & Marine Engineering (Group)'s earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year CSSC Offshore & Marine Engineering (Group)'s revenue was pretty flat, and it made a negative EBIT. While that hardly impresses, its not too bad either.

So How Risky Is CSSC Offshore & Marine Engineering (Group)?

Although CSSC Offshore & Marine Engineering (Group) had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of CN¥79m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for CSSC Offshore & Marine Engineering (Group) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:317

CSSC Offshore & Marine Engineering (Group)

Manufactures and sells marine and defense equipment in the People’s Republic of China, other regions in Asia, Europe, Oceania, North America, South America, and Africa.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026