- Hong Kong

- /

- Electrical

- /

- SEHK:2727

Strong week for Shanghai Electric Group (HKG:2727) shareholders doesn't alleviate pain of five-year loss

Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. So we wouldn't blame long term Shanghai Electric Group Company Limited (HKG:2727) shareholders for doubting their decision to hold, with the stock down 31% over a half decade.

While the last five years has been tough for Shanghai Electric Group shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Shanghai Electric Group

Shanghai Electric Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Shanghai Electric Group saw its revenue increase by 6.4% per year. That's a pretty good rate for a long time period. Shareholders have seen the share price fall at 6% per year, for five years: a poor performance. Those who bought back then clearly believed in stronger growth - and maybe even profits. There is always a big risk of losing money yourself when you buy shares in a company that loses money.

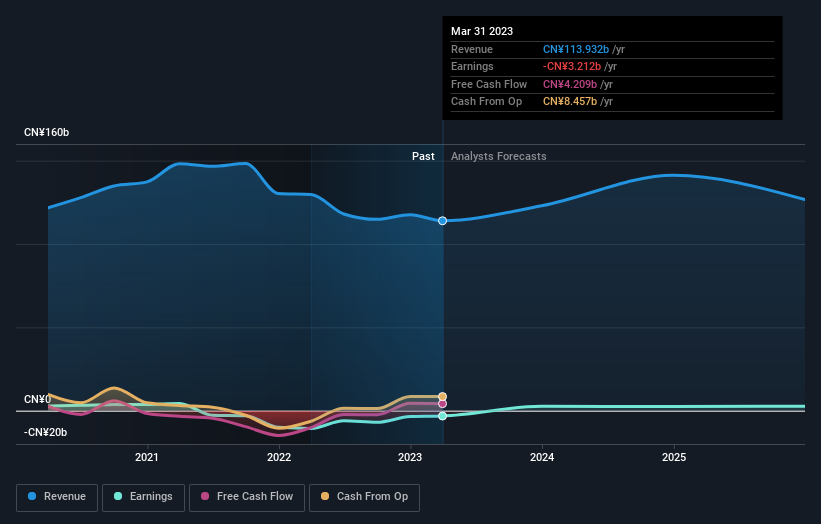

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Shanghai Electric Group in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

We've already covered Shanghai Electric Group's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Shanghai Electric Group's TSR, which was a 23% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We're pleased to report that Shanghai Electric Group shareholders have received a total shareholder return of 0.5% over one year. Notably the five-year annualised TSR loss of 4% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2727

Shanghai Electric Group

Provides industrial-grade eco-friendly smart system solutions in Mainland China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives