- Hong Kong

- /

- Industrials

- /

- SEHK:2722

Returns At Chongqing Machinery & Electric (HKG:2722) Are On The Way Up

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, we've noticed some promising trends at Chongqing Machinery & Electric (HKG:2722) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Chongqing Machinery & Electric:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0013 = CN¥12m ÷ (CN¥17b - CN¥7.1b) (Based on the trailing twelve months to December 2020).

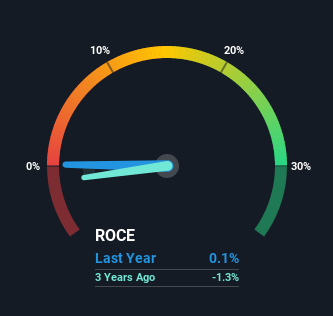

Therefore, Chongqing Machinery & Electric has an ROCE of 0.1%. Ultimately, that's a low return and it under-performs the Industrials industry average of 3.5%.

See our latest analysis for Chongqing Machinery & Electric

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Chongqing Machinery & Electric's past further, check out this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

The fact that Chongqing Machinery & Electric is now generating some pre-tax profits from its prior investments is very encouraging. About five years ago the company was generating losses but things have turned around because it's now earning 0.1% on its capital. In addition to that, Chongqing Machinery & Electric is employing 21% more capital than previously which is expected of a company that's trying to break into profitability. We like this trend, because it tells us the company has profitable reinvestment opportunities available to it, and if it continues going forward that can lead to a multi-bagger performance.

On a side note, Chongqing Machinery & Electric's current liabilities are still rather high at 43% of total assets. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

Our Take On Chongqing Machinery & Electric's ROCE

Overall, Chongqing Machinery & Electric gets a big tick from us thanks in most part to the fact that it is now profitable and is reinvesting in its business. Given the stock has declined 28% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. With that in mind, we believe the promising trends warrant this stock for further investigation.

One more thing: We've identified 3 warning signs with Chongqing Machinery & Electric (at least 1 which is potentially serious) , and understanding them would certainly be useful.

While Chongqing Machinery & Electric may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Chongqing Machinery & Electric, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2722

Chongqing Machinery & Electric

Designs, manufactures, and sells clean energy equipment and high-end smart manufacturing equipment.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives