- Hong Kong

- /

- Industrials

- /

- SEHK:2722

Chongqing Machinery & Electric Co., Ltd.'s (HKG:2722) CEO Compensation Looks Acceptable To Us And Here's Why

Performance at Chongqing Machinery & Electric Co., Ltd. (HKG:2722) has been rather uninspiring recently and shareholders may be wondering how CEO Ping Chen plans to fix this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 24 June 2021. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

View our latest analysis for Chongqing Machinery & Electric

How Does Total Compensation For Ping Chen Compare With Other Companies In The Industry?

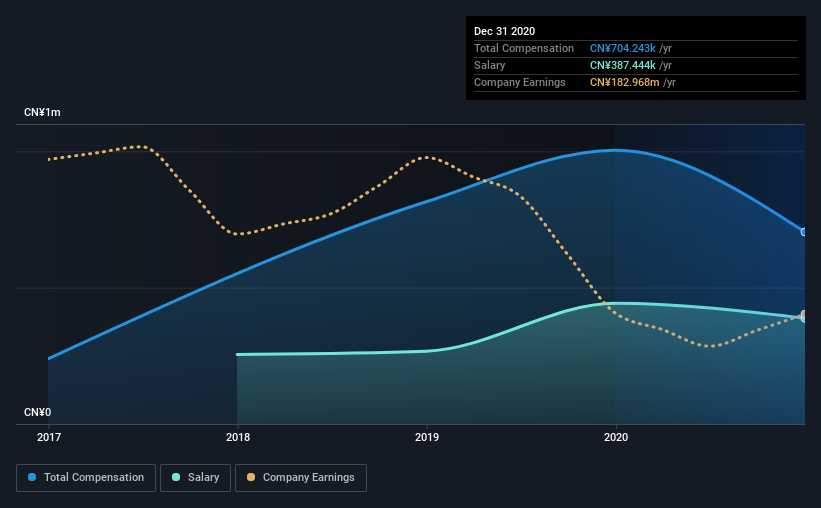

Our data indicates that Chongqing Machinery & Electric Co., Ltd. has a market capitalization of HK$2.0b, and total annual CEO compensation was reported as CN¥704k for the year to December 2020. We note that's a decrease of 30% compared to last year. We note that the salary of CN¥387.4k makes up a sizeable portion of the total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between HK$776m and HK$3.1b had a median total CEO compensation of CN¥2.2m. Accordingly, Chongqing Machinery & Electric pays its CEO under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥387k | CN¥443k | 55% |

| Other | CN¥317k | CN¥561k | 45% |

| Total Compensation | CN¥704k | CN¥1.0m | 100% |

Speaking on an industry level, nearly 59% of total compensation represents salary, while the remainder of 41% is other remuneration. Our data reveals that Chongqing Machinery & Electric allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Chongqing Machinery & Electric Co., Ltd.'s Growth Numbers

Over the last three years, Chongqing Machinery & Electric Co., Ltd. has shrunk its earnings per share by 18% per year. It achieved revenue growth of 15% over the last year.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Chongqing Machinery & Electric Co., Ltd. Been A Good Investment?

Given the total shareholder loss of 14% over three years, many shareholders in Chongqing Machinery & Electric Co., Ltd. are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Shareholders will be disappointed with the share price performance as they go into the AGM. One reason for the lacklustre price performance could be that earnings just haven't grown much. Shareholders will get the chance to question the board on key concerns and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 3 warning signs for Chongqing Machinery & Electric (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2722

Chongqing Machinery & Electric

Designs, manufactures, and sells clean energy equipment and high-end smart manufacturing equipment.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives