- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2326

Revenues Not Telling The Story For New Provenance Everlasting Holdings Limited (HKG:2326)

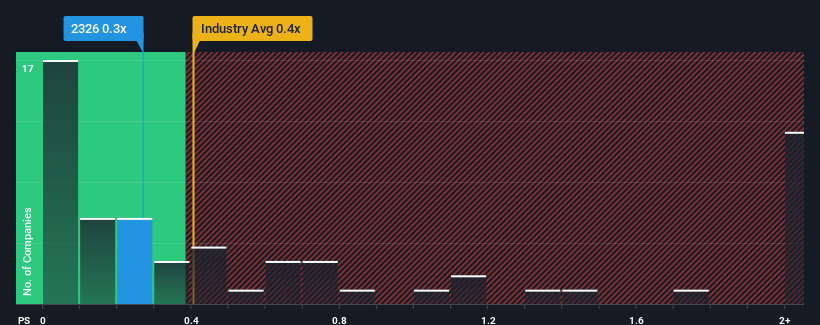

There wouldn't be many who think New Provenance Everlasting Holdings Limited's (HKG:2326) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Trade Distributors industry in Hong Kong is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for New Provenance Everlasting Holdings

How Has New Provenance Everlasting Holdings Performed Recently?

As an illustration, revenue has deteriorated at New Provenance Everlasting Holdings over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on New Provenance Everlasting Holdings will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For New Provenance Everlasting Holdings?

New Provenance Everlasting Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 54% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 44% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is predicted to deliver 21% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it interesting that New Provenance Everlasting Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that New Provenance Everlasting Holdings' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

And what about other risks? Every company has them, and we've spotted 2 warning signs for New Provenance Everlasting Holdings (of which 1 can't be ignored!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if New Provenance Everlasting Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2326

New Provenance Everlasting Holdings

An investment holding company, sources and sells metal minerals and related industrial materials in Hong Kong and the People’s Republic of China.

Flawless balance sheet low.

Market Insights

Community Narratives