Morimatsu International Holdings Company Limited (HKG:2155) Stock Rockets 33% But Many Are Still Ignoring The Company

Morimatsu International Holdings Company Limited (HKG:2155) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.2% in the last twelve months.

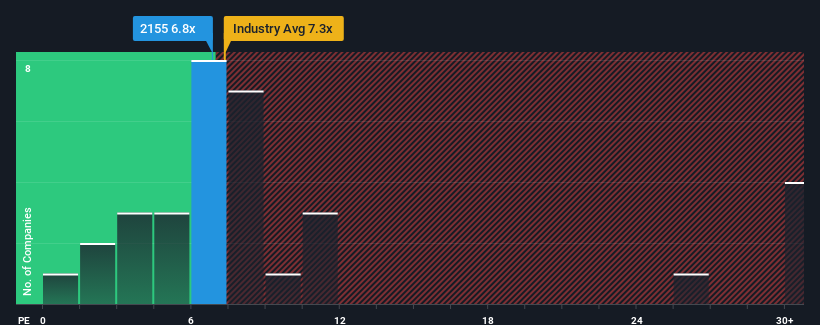

In spite of the firm bounce in price, Morimatsu International Holdings may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.8x, since almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Morimatsu International Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Morimatsu International Holdings

How Is Morimatsu International Holdings' Growth Trending?

Morimatsu International Holdings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 4.7%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 123% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 15% per year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 12% each year, which is noticeably less attractive.

With this information, we find it odd that Morimatsu International Holdings is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Morimatsu International Holdings' P/E

Despite Morimatsu International Holdings' shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Morimatsu International Holdings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Morimatsu International Holdings (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Morimatsu International Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2155

Morimatsu International Holdings

Designs, manufactures, installs, operates, and maintains process equipment, process systems, and solutions primarily for chemical, polymerization, and bio-reactions in China and internationally.

Flawless balance sheet with reasonable growth potential.