- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2102

Does Tak Lee Machinery Holdings (HKG:2102) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Tak Lee Machinery Holdings Limited (HKG:2102) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Tak Lee Machinery Holdings

What Is Tak Lee Machinery Holdings's Net Debt?

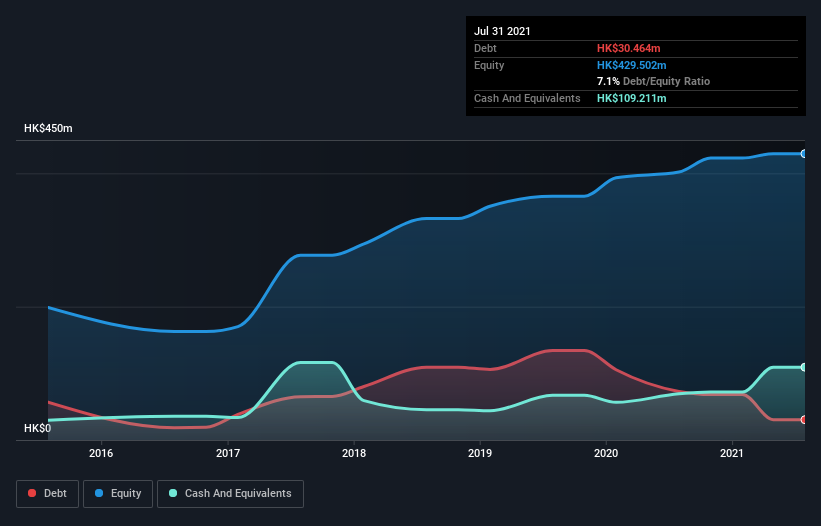

The image below, which you can click on for greater detail, shows that Tak Lee Machinery Holdings had debt of HK$30.5m at the end of July 2021, a reduction from HK$72.9m over a year. However, it does have HK$109.2m in cash offsetting this, leading to net cash of HK$78.7m.

How Healthy Is Tak Lee Machinery Holdings' Balance Sheet?

According to the last reported balance sheet, Tak Lee Machinery Holdings had liabilities of HK$54.9m due within 12 months, and liabilities of HK$26.0m due beyond 12 months. Offsetting these obligations, it had cash of HK$109.2m as well as receivables valued at HK$103.5m due within 12 months. So it actually has HK$131.8m more liquid assets than total liabilities.

This luscious liquidity implies that Tak Lee Machinery Holdings' balance sheet is sturdy like a giant sequoia tree. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Simply put, the fact that Tak Lee Machinery Holdings has more cash than debt is arguably a good indication that it can manage its debt safely.

But the other side of the story is that Tak Lee Machinery Holdings saw its EBIT decline by 4.7% over the last year. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Tak Lee Machinery Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Tak Lee Machinery Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Tak Lee Machinery Holdings recorded free cash flow worth a fulsome 88% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While it is always sensible to investigate a company's debt, in this case Tak Lee Machinery Holdings has HK$78.7m in net cash and a decent-looking balance sheet. And it impressed us with free cash flow of HK$77m, being 88% of its EBIT. So we don't think Tak Lee Machinery Holdings's use of debt is risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Tak Lee Machinery Holdings is showing 2 warning signs in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Tak Lee Machinery Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2102

Tak Lee Machinery Holdings

An investment holding company, engages in the sale and leasing of new and used earthmoving equipment and spare parts in Hong Kong.

Flawless balance sheet low.