Yonghui Peng has been the CEO of Chanhigh Holdings Limited (HKG:2017) since 2017, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Chanhigh Holdings.

See our latest analysis for Chanhigh Holdings

How Does Total Compensation For Yonghui Peng Compare With Other Companies In The Industry?

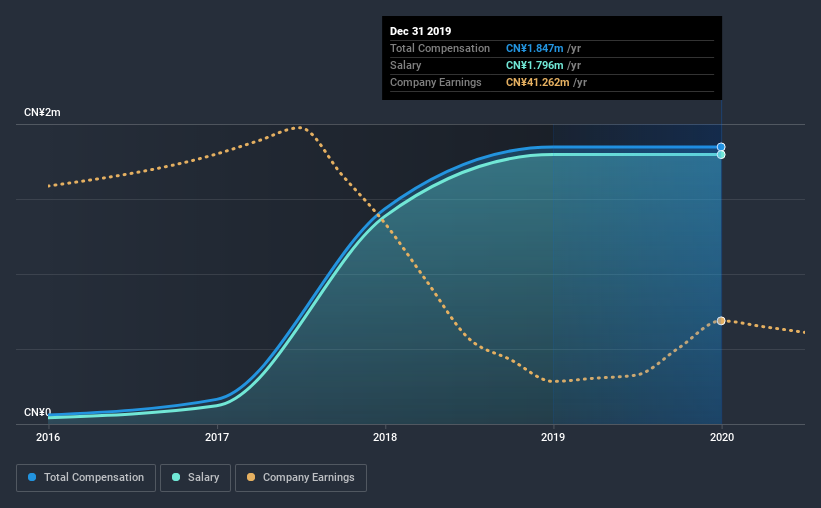

According to our data, Chanhigh Holdings Limited has a market capitalization of HK$328m, and paid its CEO total annual compensation worth CN¥1.8m over the year to December 2019. That's mostly flat as compared to the prior year's compensation. In particular, the salary of CN¥1.80m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of CN¥1.6m. From this we gather that Yonghui Peng is paid around the median for CEOs in the industry. Furthermore, Yonghui Peng directly owns HK$231m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CN¥1.8m | CN¥1.8m | 97% |

| Other | CN¥51k | CN¥51k | 3% |

| Total Compensation | CN¥1.8m | CN¥1.8m | 100% |

Talking in terms of the industry, salary represented approximately 91% of total compensation out of all the companies we analyzed, while other remuneration made up 8.7% of the pie. Investors will find it interesting that Chanhigh Holdings pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Chanhigh Holdings Limited's Growth Numbers

Over the last three years, Chanhigh Holdings Limited has shrunk its earnings per share by 37% per year. In the last year, its revenue is up 69%.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Chanhigh Holdings Limited Been A Good Investment?

Since shareholders would have lost about 65% over three years, some Chanhigh Holdings Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

Yonghui receives almost all of their compensation through a salary. As we noted earlier, Chanhigh Holdings pays its CEO in line with similar-sized companies belonging to the same industry. But revenue growth seems to be inching northward, a heartening sign for the company. Contrarily, shareholder returns are in the red over the same stretch. EPS growth is bleak as well, adding fuel to the fire. We'd say CEO compensation isn't unfair, but shareholders may be wary of a bump in pay before the company substantially improves overall performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 4 warning signs for Chanhigh Holdings you should be aware of, and 2 of them shouldn't be ignored.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Chanhigh Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Chanhigh Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:2017

Chanhigh Holdings

An investment holding company, provides landscape and municipal works construction and maintenance services in the People’s Republic of China and Hong Kong.

Flawless balance sheet and good value.

Market Insights

Community Narratives