- Hong Kong

- /

- Construction

- /

- SEHK:1987

With Beng Soon Machinery Holdings Limited (HKG:1987) It Looks Like You'll Get What You Pay For

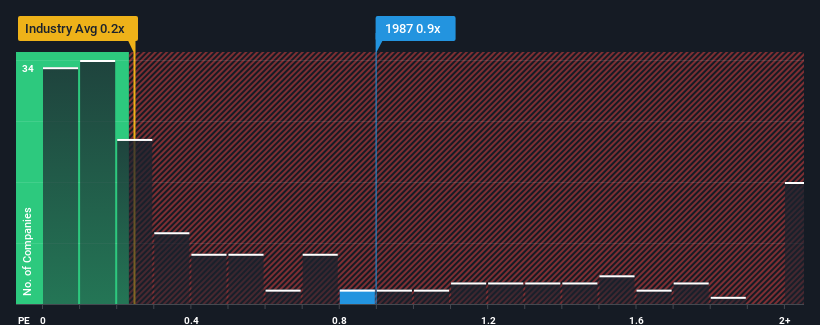

Beng Soon Machinery Holdings Limited's (HKG:1987) price-to-sales (or "P/S") ratio of 0.9x may not look like an appealing investment opportunity when you consider close to half the companies in the Construction industry in Hong Kong have P/S ratios below 0.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Beng Soon Machinery Holdings

How Beng Soon Machinery Holdings Has Been Performing

The revenue growth achieved at Beng Soon Machinery Holdings over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Beng Soon Machinery Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Beng Soon Machinery Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 122% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 8.8% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Beng Soon Machinery Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Beng Soon Machinery Holdings' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that Beng Soon Machinery Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Beng Soon Machinery Holdings that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beng Soon Machinery Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1987

Beng Soon Machinery Holdings

Beng Soon Machinery Holdings Limited, investment holding company, provides demolition services to public and private sector clients in Singapore.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives