As global markets navigate the uncertainties surrounding policy changes under the new U.S. administration and fluctuating interest rates, investors are keenly observing sector-specific impacts and broader economic indicators. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for portfolios seeking to balance growth with reliable returns amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.57% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.76% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.75% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.57% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

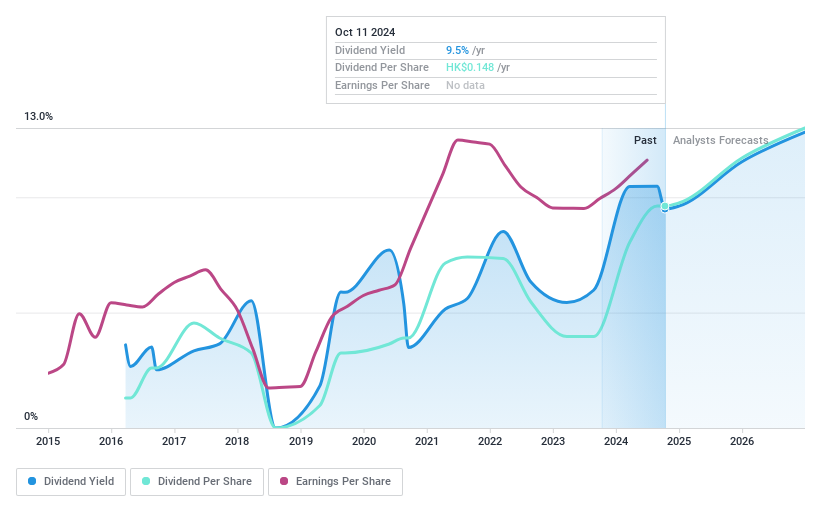

Ten Pao Group Holdings (SEHK:1979)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ten Pao Group Holdings Limited is an investment holding company that develops, manufactures, and sells electric charging products across various regions including the People's Republic of China, Asia, the United States, Europe, and Africa with a market cap of HK$1.60 billion.

Operations: Ten Pao Group Holdings Limited generates revenue from several segments, including Lighting (HK$298.56 million), Telecommunication (HK$1.46 billion), New Energy Business (HK$820.12 million), Media and Entertainment (HK$370.37 million), and Smart Chargers and Controllers (HK$1.81 billion).

Dividend Yield: 9.5%

Ten Pao Group Holdings' recent interim dividend of HKD 0.052 per share reflects its commitment to returning value to shareholders, supported by a payout ratio of 41.4% and cash payout ratio of 37.1%, indicating dividends are well-covered by earnings and cash flows. Despite trading at a significant discount to estimated fair value, the company's nine-year dividend history is marked by volatility, with payments not consistently growing, posing concerns for long-term reliability.

- Get an in-depth perspective on Ten Pao Group Holdings' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Ten Pao Group Holdings is priced lower than what may be justified by its financials.

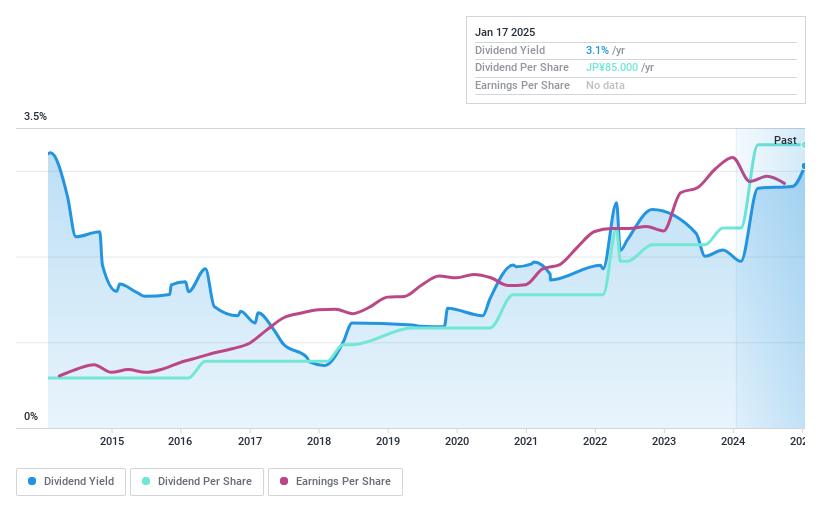

NSW (TSE:9739)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NSW Inc. operates in Japan offering enterprise, services, embedded, and device solutions with a market cap of ¥45.44 billion.

Operations: NSW Inc. generates revenue through its enterprise, services, embedded, and device solutions segments in Japan.

Dividend Yield: 3.1%

NSW Inc.'s dividend stability over the past decade is underscored by a consistent increase in payments, recently announcing a JPY 40.00 per share dividend for Q2 FY2025, up from JPY 30.00 last year. With a low earnings payout ratio of 19.3% and cash payout ratio of 53.1%, dividends are well-covered by both earnings and cash flows. Despite its attractive valuation with a P/E ratio of 10.7x, its yield remains below top-tier JP market payers at 3.11%.

- Click here to discover the nuances of NSW with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of NSW shares in the market.

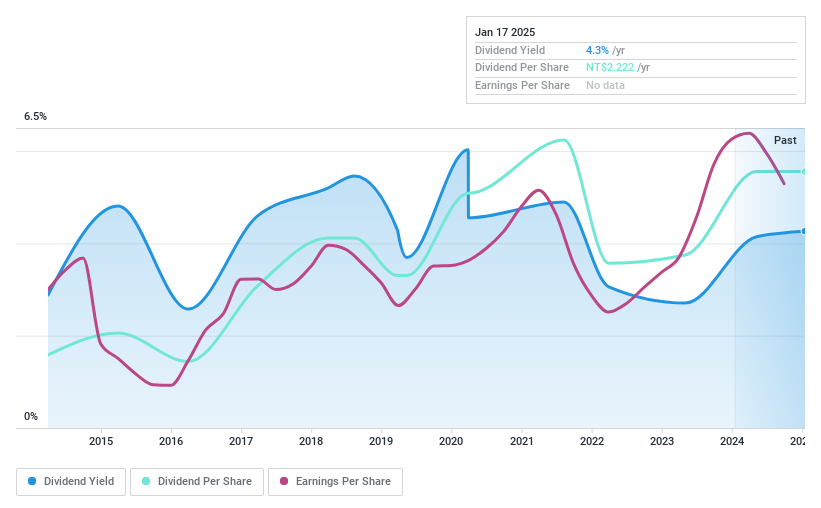

Great Wall Enterprise (TWSE:1210)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Great Wall Enterprise Co., Ltd. manufactures and sells agriculture and grain, meat, and processed food products in Taiwan, China, Vietnam, and internationally with a market cap of NT$44.57 billion.

Operations: Great Wall Enterprise Co., Ltd. generates revenue through its agriculture and grain, meat, and processed food product segments across Taiwan, China, Vietnam, and international markets.

Dividend Yield: 4.2%

Great Wall Enterprise's dividend payments are supported by a reasonable payout ratio of 54.6% and a low cash payout ratio of 37.3%, indicating coverage by both earnings and cash flows. However, the dividend history is unreliable, with volatility over the past decade despite some growth. The recent earnings report showed declines in sales and net income for Q3 2024, which may impact future dividends. Its current yield of 4.22% is below Taiwan's top-tier payers at 4.53%.

- Click to explore a detailed breakdown of our findings in Great Wall Enterprise's dividend report.

- The valuation report we've compiled suggests that Great Wall Enterprise's current price could be quite moderate.

Next Steps

- Click through to start exploring the rest of the 1953 Top Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NSW might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9739

NSW

Provides enterprise, services, embedded, and device solutions in Japan.

Flawless balance sheet established dividend payer.