- Hong Kong

- /

- Electrical

- /

- SEHK:1979

Is Now The Time To Put Ten Pao Group Holdings (HKG:1979) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Ten Pao Group Holdings (HKG:1979), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Ten Pao Group Holdings

How Fast Is Ten Pao Group Holdings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Ten Pao Group Holdings has grown EPS by 23% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

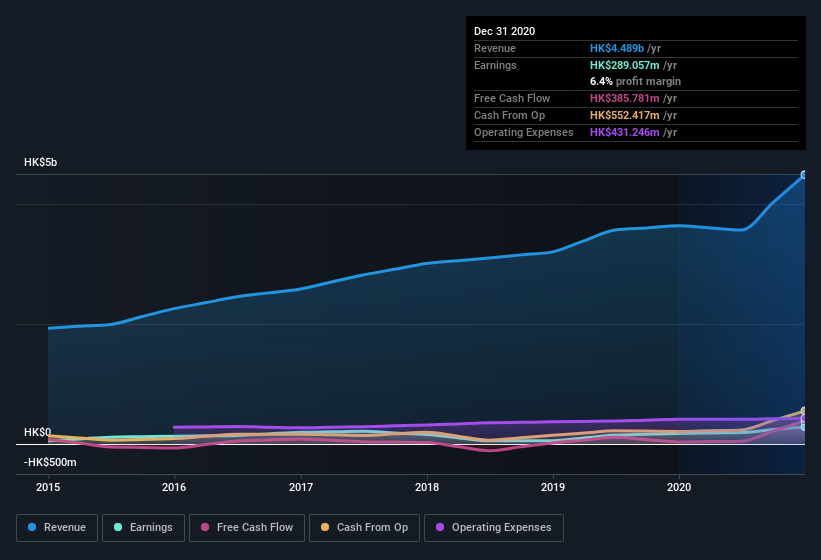

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Ten Pao Group Holdings is growing revenues, and EBIT margins improved by 3.0 percentage points to 9.6%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Ten Pao Group Holdings EPS 100% free.

Are Ten Pao Group Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Insider selling of Ten Pao Group Holdings shares was insignificant compared to the one buyer, over the last twelve months. Specifically the Chairman & CEO, Kwong Yee Hung, spent HK$5.4m, paying about HK$1.20 per share. That certainly pricks my ears up.

On top of the insider buying, we can also see that Ten Pao Group Holdings insiders own a large chunk of the company. Indeed, with a collective holding of 66%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have HK$1.3b invested in the business, using the current share price. That's nothing to sneeze at!

Should You Add Ten Pao Group Holdings To Your Watchlist?

For growth investors like me, Ten Pao Group Holdings's raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. You should always think about risks though. Case in point, we've spotted 2 warning signs for Ten Pao Group Holdings you should be aware of.

The good news is that Ten Pao Group Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ten Pao Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1979

Ten Pao Group Holdings

An investment holding company, engages in the development, manufacture, and sale of electric charging products in the People’s Republic of China, the rest of Asia, the United States, Europe, Africa, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives