- Hong Kong

- /

- Construction

- /

- SEHK:1943

We're Hopeful That Silver Tide Holdings (HKG:1943) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, Silver Tide Holdings (HKG:1943) shareholders have done very well over the last year, with the share price soaring by 208%. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

In light of its strong share price run, we think now is a good time to investigate how risky Silver Tide Holdings' cash burn is. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Silver Tide Holdings

Does Silver Tide Holdings Have A Long Cash Runway?

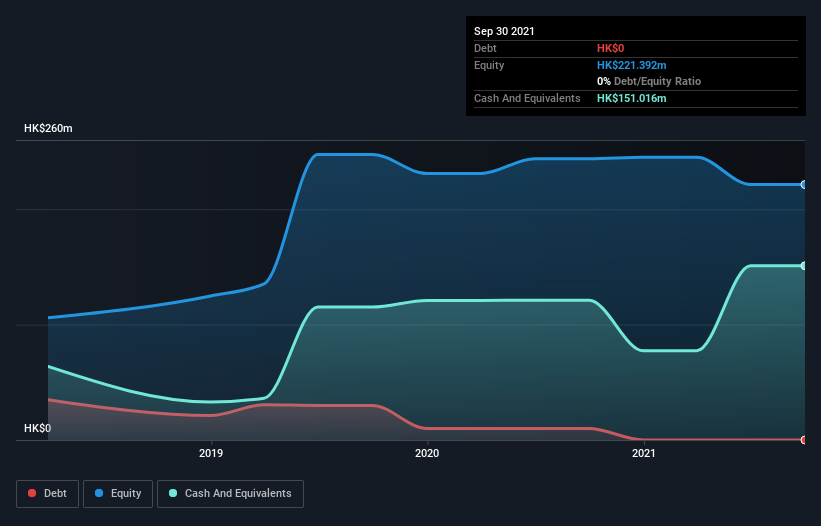

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at September 2021, Silver Tide Holdings had cash of HK$151m and no debt. In the last year, its cash burn was HK$32m. Therefore, from September 2021 it had 4.7 years of cash runway. There's no doubt that this is a reassuringly long runway. You can see how its cash balance has changed over time in the image below.

Is Silver Tide Holdings' Revenue Growing?

Given that Silver Tide Holdings actually had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory. While it's not that amazing, we still think that the 3.9% increase in revenue from operations was a positive. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Silver Tide Holdings has developed its business over time by checking this visualization of its revenue and earnings history.

Can Silver Tide Holdings Raise More Cash Easily?

Notwithstanding Silver Tide Holdings' revenue growth, it is still important to consider how it could raise more money, if it needs to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Silver Tide Holdings' cash burn of HK$32m is about 6.0% of its HK$530m market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is Silver Tide Holdings' Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Silver Tide Holdings is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. On this analysis its revenue growth was its weakest feature, but we are not concerned about it. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Taking a deeper dive, we've spotted 2 warning signs for Silver Tide Holdings you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking to trade King's Stone Holdings Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if King's Stone Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1943

King's Stone Holdings Group

An investment holding company, provides construction services for the public and private sectors in Hong Kong.

Moderate with adequate balance sheet.

Market Insights

Community Narratives