Revenues Not Telling The Story For Beijing Jingcheng Machinery Electric Company Limited (HKG:187) After Shares Rise 36%

Beijing Jingcheng Machinery Electric Company Limited (HKG:187) shareholders have had their patience rewarded with a 36% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 54% in the last year.

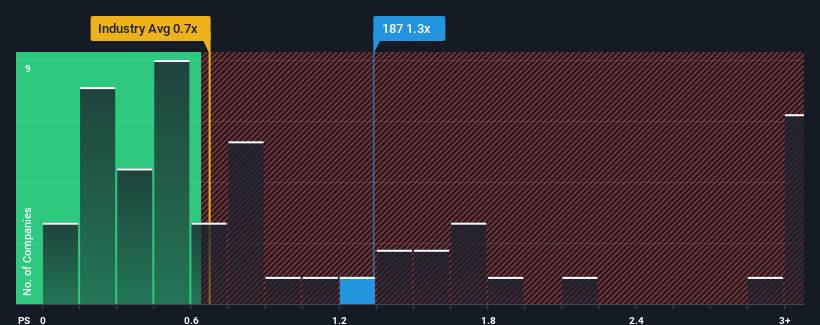

Since its price has surged higher, when almost half of the companies in Hong Kong's Machinery industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Beijing Jingcheng Machinery Electric as a stock probably not worth researching with its 1.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Beijing Jingcheng Machinery Electric

How Beijing Jingcheng Machinery Electric Has Been Performing

The revenue growth achieved at Beijing Jingcheng Machinery Electric over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Beijing Jingcheng Machinery Electric, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Beijing Jingcheng Machinery Electric would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 34% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 15% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it worrying that Beijing Jingcheng Machinery Electric's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Beijing Jingcheng Machinery Electric's P/S?

Beijing Jingcheng Machinery Electric's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Beijing Jingcheng Machinery Electric revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Beijing Jingcheng Machinery Electric with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jingcheng Machinery Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:187

Beijing Jingcheng Machinery Electric

Manufactures and sells gas storage and transportation equipment in the People’s Republic of China and internationally.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives