- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1848

China Aircraft Leasing Group Holdings (HKG:1848) Has Announced That Its Dividend Will Be Reduced To HK$0.15

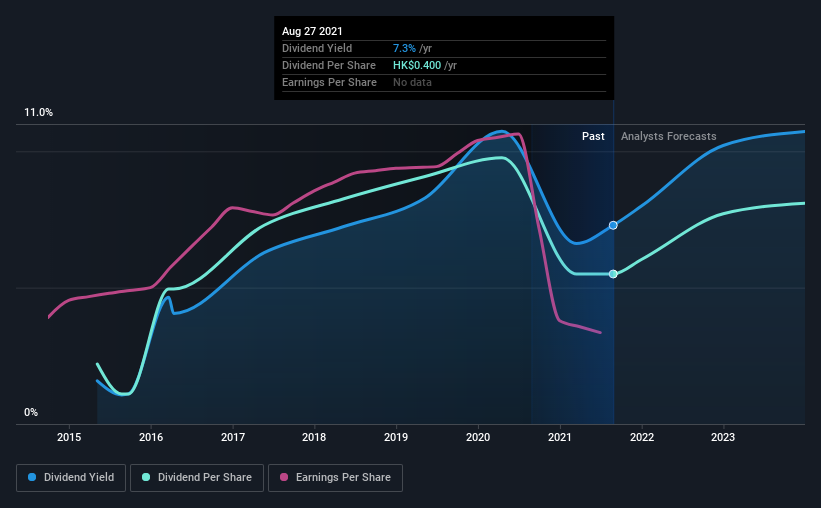

The board of China Aircraft Leasing Group Holdings Limited (HKG:1848) has announced that the dividend on 4th of November will be reduced by 25% to HK$0.15. However, the dividend yield of 6.4% is still a decent boost to shareholder returns.

Check out our latest analysis for China Aircraft Leasing Group Holdings

China Aircraft Leasing Group Holdings' Dividend Is Well Covered By Earnings

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Based on the last payment, China Aircraft Leasing Group Holdings' earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

Looking forward, earnings per share is forecast to rise by 186.3% over the next year. If the dividend continues on this path, the payout ratio could be 32% by next year, which we think can be pretty sustainable going forward.

China Aircraft Leasing Group Holdings' Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2015, the first annual payment was HK$0.16, compared to the most recent full-year payment of HK$0.40. This means that it has been growing its distributions at 16% per annum over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. China Aircraft Leasing Group Holdings' earnings per share has shrunk at 12% a year over the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

The Dividend Could Prove To Be Unreliable

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think China Aircraft Leasing Group Holdings is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 5 warning signs for China Aircraft Leasing Group Holdings you should be aware of, and 1 of them is a bit concerning. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1848

China Aircraft Leasing Group Holdings

An investment holding company, provides aircraft leasing services to airline companies in Mainland China and internationally.

High growth potential with acceptable track record.

Market Insights

Community Narratives