- Hong Kong

- /

- Construction

- /

- SEHK:1793

Wecon Holdings (HKG:1793) Has Announced That Its Dividend Will Be Reduced To HK$0.012

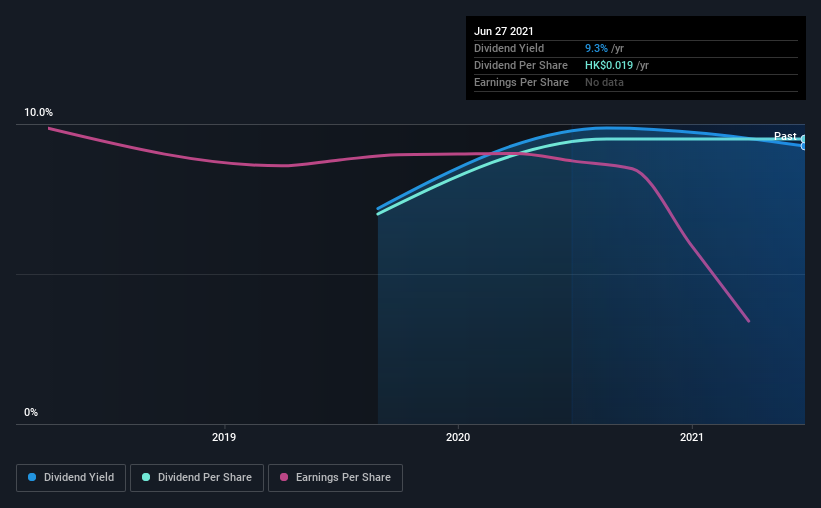

Wecon Holdings Limited (HKG:1793) is reducing its dividend to HK$0.012 on the 20th of Septemberwhich is 37% less than last year. This means the annual payment is 5.9% of the current stock price, which is above the average for the industry.

Check out our latest analysis for Wecon Holdings

Wecon Holdings' Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, Wecon Holdings was paying out a fairly large proportion of earnings, and it wasn't generating positive free cash flows either. Generally, we think that this would be a risky long term practice.

EPS is set to fall by 29.7% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, the payout ratio in 12 months could be 45%, which is more comfortable than the current payout ratio.

Wecon Holdings Is Still Building Its Track Record

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. Since 2019, the dividend has gone from HK$0.014 to HK$0.019. This works out to be a compound annual growth rate (CAGR) of approximately 16% a year over that time. Wecon Holdings has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, initial appearances might be deceiving. Wecon Holdings' EPS has fallen by approximately 30% per year during the past three years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

Wecon Holdings' Dividend Doesn't Look Sustainable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The track record isn't great, and the payments are a bit high to be considered sustainable. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 3 warning signs for Wecon Holdings that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wecon Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1793

Wecon Holdings

An investment holding company, operates as a construction contractor in Hong Kong.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026