Some Investors May Be Worried About CRCC High-Tech Equipment's (HKG:1786) Returns On Capital

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. This indicates the company is producing less profit from its investments and its total assets are decreasing. And from a first read, things don't look too good at CRCC High-Tech Equipment (HKG:1786), so let's see why.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for CRCC High-Tech Equipment:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.008 = CN¥47m ÷ (CN¥8.3b - CN¥2.4b) (Based on the trailing twelve months to June 2022).

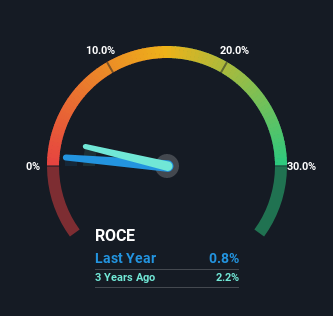

Thus, CRCC High-Tech Equipment has an ROCE of 0.8%. In absolute terms, that's a low return and it also under-performs the Machinery industry average of 7.0%.

View our latest analysis for CRCC High-Tech Equipment

Above you can see how the current ROCE for CRCC High-Tech Equipment compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for CRCC High-Tech Equipment.

What Does the ROCE Trend For CRCC High-Tech Equipment Tell Us?

In terms of CRCC High-Tech Equipment's historical ROCE movements, the trend doesn't inspire confidence. About five years ago, returns on capital were 5.6%, however they're now substantially lower than that as we saw above. Meanwhile, capital employed in the business has stayed roughly the flat over the period. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. If these trends continue, we wouldn't expect CRCC High-Tech Equipment to turn into a multi-bagger.

The Bottom Line On CRCC High-Tech Equipment's ROCE

In summary, it's unfortunate that CRCC High-Tech Equipment is generating lower returns from the same amount of capital. Long term shareholders who've owned the stock over the last five years have experienced a 53% depreciation in their investment, so it appears the market might not like these trends either. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

If you'd like to know about the risks facing CRCC High-Tech Equipment, we've discovered 2 warning signs that you should be aware of.

While CRCC High-Tech Equipment isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you're looking to trade CRCC High-Tech Equipment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1786

CRCC High-Tech Equipment

Researches, develops, manufactures, and sells large railway track maintenance machinery in Mainland China and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives