- Hong Kong

- /

- Electrical

- /

- SEHK:1729

Time Interconnect Technology's (HKG:1729) Stock Price Has Reduced 20% In The Past Year

Time Interconnect Technology Limited (HKG:1729) shareholders should be happy to see the share price up 13% in the last quarter. But in truth the last year hasn't been good for the share price. In fact, the price has declined 20% in a year, falling short of the returns you could get by investing in an index fund.

Check out our latest analysis for Time Interconnect Technology

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Time Interconnect Technology share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

Vibrant companies don't usually cut their dividends, so the recent reduction might help explain why the Time Interconnect Technology share price has been weak.

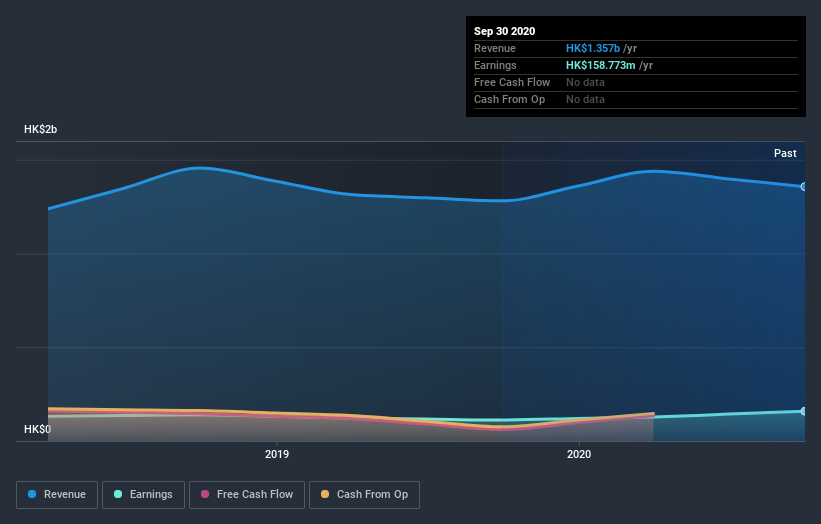

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Time Interconnect Technology, it has a TSR of -13% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Given that the market gained 7.8% in the last year, Time Interconnect Technology shareholders might be miffed that they lost 13% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 13%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Time Interconnect Technology better, we need to consider many other factors. For instance, we've identified 3 warning signs for Time Interconnect Technology (1 makes us a bit uncomfortable) that you should be aware of.

But note: Time Interconnect Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Time Interconnect Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Time Interconnect Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1729

Time Interconnect Technology

An investment holding company, manufactures and sells cable assembly and networking cable products in the People's Republic of China, the United States, the Netherlands, Singapore, the United Kingdom, Hong Kong, Mexico, and internationally.

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives