- Taiwan

- /

- Metals and Mining

- /

- TWSE:9958

ORION Holdings And 2 Other Undiscovered Gems In Asia With Promising Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and economic indicators, Asian stocks have shown resilience amid fluctuating investor sentiment. In this dynamic environment, discovering promising small-cap companies can provide opportunities for growth, as these firms often exhibit unique value propositions and potential for expansion in their respective sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 5.05% | 16.94% | ★★★★★★ |

| Natural Food International Holding | NA | 5.61% | 32.98% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Neosem | 1.48% | 23.75% | 22.84% | ★★★★★★ |

| Shanghai Haixin Group | 0.58% | -2.63% | 6.76% | ★★★★★★ |

| Tohoku Steel | NA | 5.34% | -2.26% | ★★★★★★ |

| Ningbo Henghe Precision IndustryLtd | 66.02% | 5.50% | 23.91% | ★★★★☆☆ |

| Techno Smart | 10.18% | 12.81% | 17.66% | ★★★★☆☆ |

| Red phase | 1.92% | -11.27% | -29.84% | ★★★★☆☆ |

We'll examine a selection from our screener results.

ORION Holdings (KOSE:A001800)

Simply Wall St Value Rating: ★★★★★★

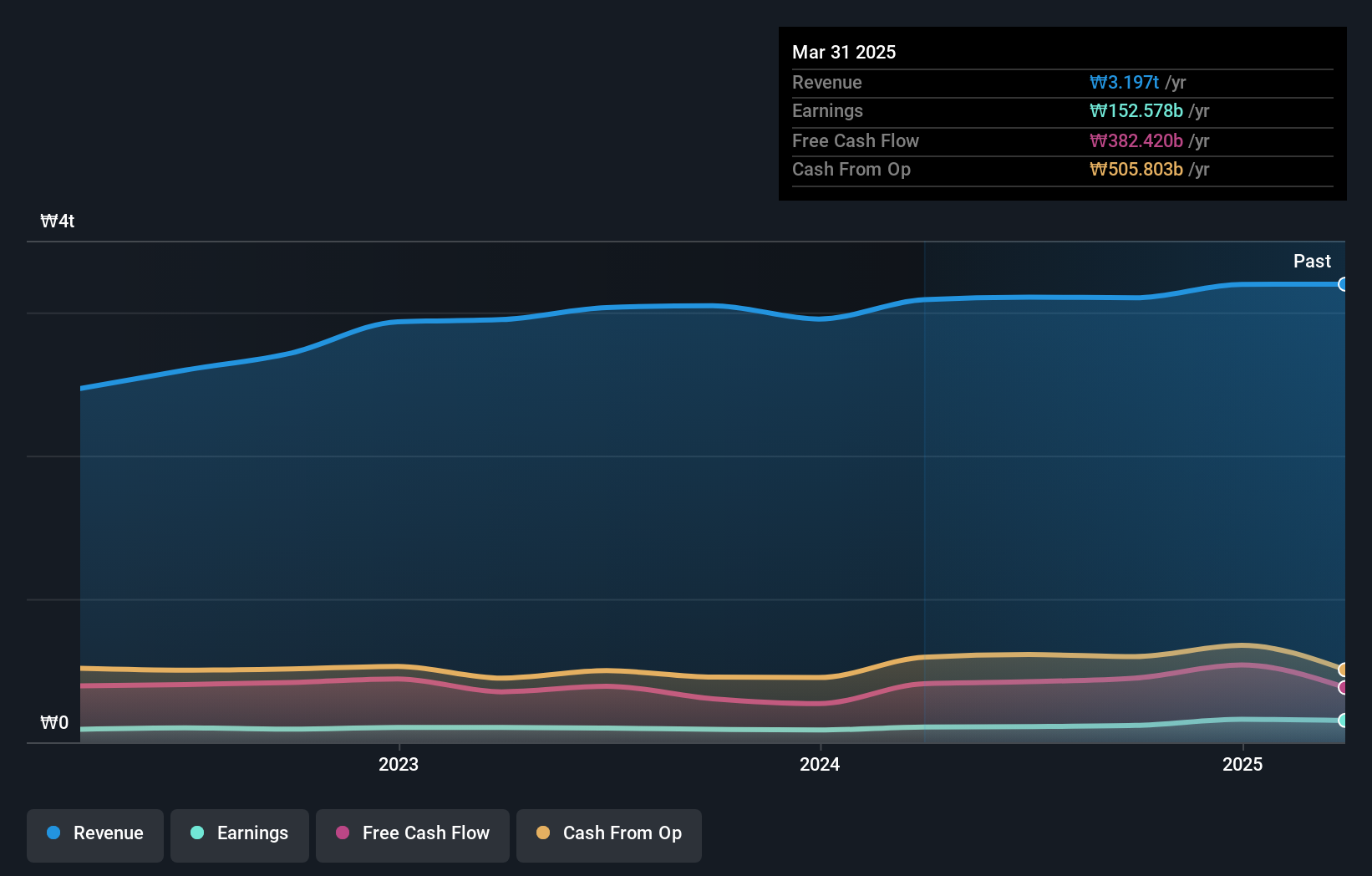

Overview: ORION Holdings Corp. is engaged in the manufacturing and sale of confectioneries across South Korea, China, and international markets with a market capitalization of ₩1.34 trillion.

Operations: ORION Holdings generates revenue primarily from its confectionery segment, which accounts for ₩3.90 trillion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

ORION Holdings, a promising player in the Asian market, has shown impressive financial resilience. Over the past year, its earnings surged by 43.3%, significantly outpacing the Food industry's -8.5% performance. The company's debt to equity ratio improved from 10.6% to 3.1% over five years, indicating prudent financial management with cash exceeding total debt levels. Despite a dip in Q1 net income from KRW 46 billion to KRW 38 billion compared to last year, ORION's sales nearly doubled from KRW 12 billion to KRW 24 billion during the same period, reflecting robust operational growth amidst industry challenges.

- Navigate through the intricacies of ORION Holdings with our comprehensive health report here.

Assess ORION Holdings' past performance with our detailed historical performance reports.

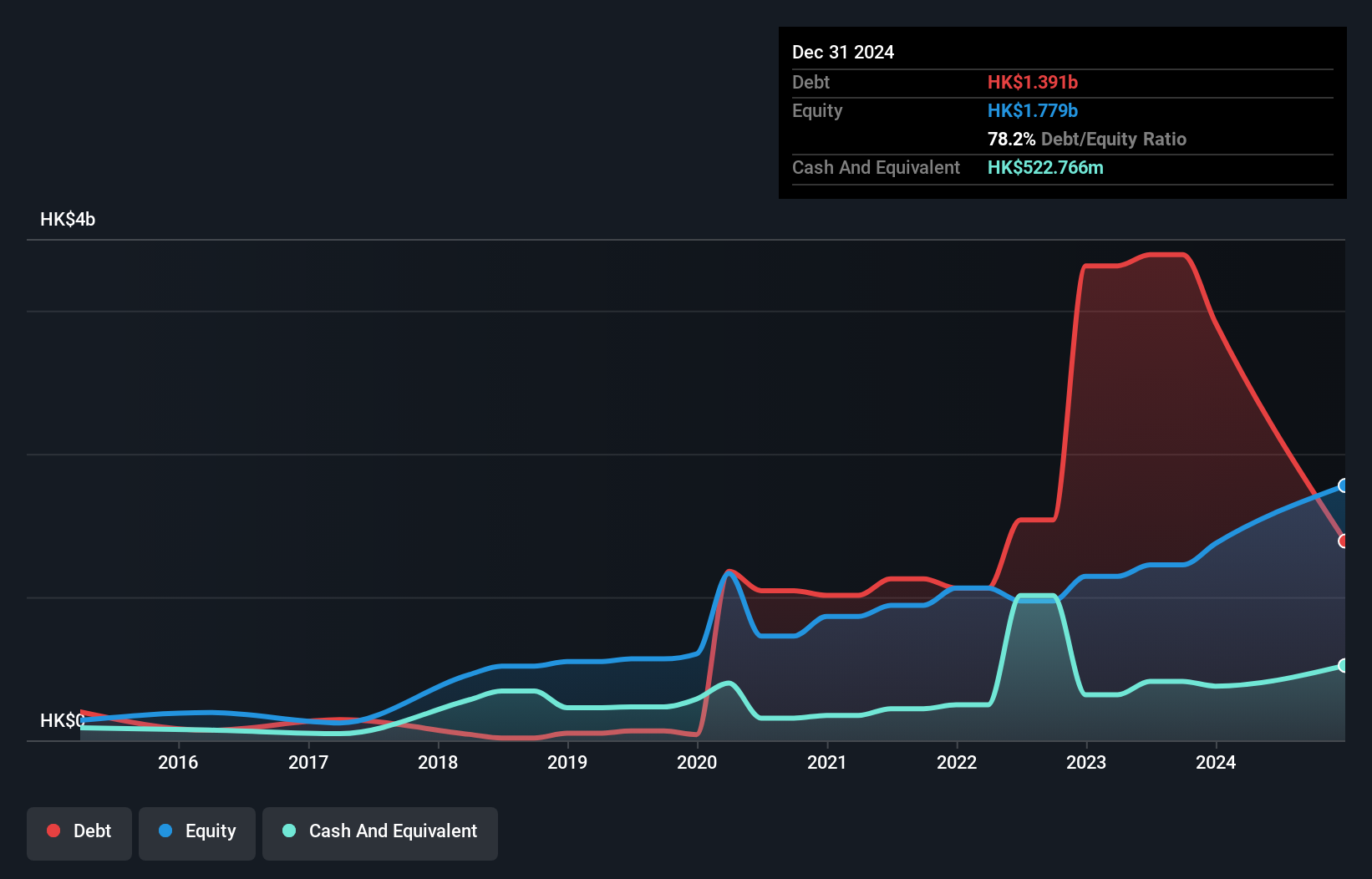

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Time Interconnect Technology Limited is an investment holding company that manufactures and sells cable assembly, digital cable, and server products across various international markets, with a market cap of approximately HK$11.51 billion.

Operations: The company's primary revenue streams include server products generating HK$3.19 billion, cable assembly at HK$2.79 billion, and digital cable contributing HK$1.44 billion.

Time Interconnect Technology, a small player in the tech sector, showcases strong earnings growth of 22%, outpacing its industry peers. Despite a high net debt to equity ratio of 48.8%, the company manages its interest payments effectively with an EBIT coverage of 11 times. Recent strategic moves include securing supply agreements with Luxvisions and BCS Automotive Interface Solutions, potentially boosting future revenue streams. The company's decision to declare a dividend of HKD 0.13 per share reflects confidence in its financial health, even as it navigates through a volatile share price landscape over recent months.

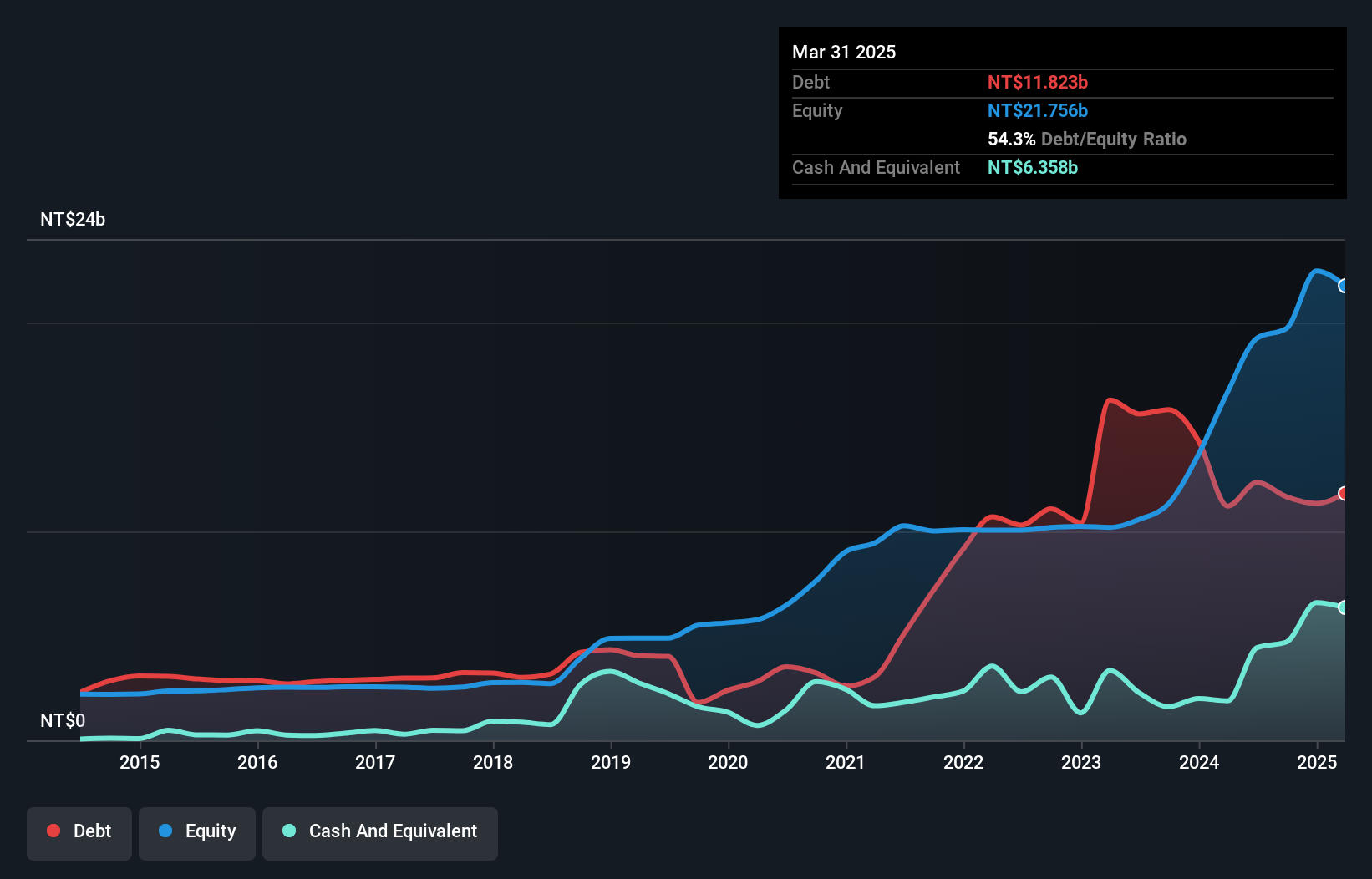

Century Iron and Steel IndustrialLtd (TWSE:9958)

Simply Wall St Value Rating: ★★★★★☆

Overview: Century Iron and Steel Industrial Ltd operates in the steel industry, focusing on the production of building reinforcing steel structures, with a market capitalization of NT$50.40 billion.

Operations: Century Iron and Steel Industrial Ltd generates revenue primarily from its building reinforcing steel structure segment, amounting to NT$13.24 billion.

Century Iron and Steel Industrial Co., Ltd. is making waves with a recent dividend increase to TWD 4.0 per share, reflecting its commitment to rewarding shareholders. Despite a dip in Q1 net income to TWD 363.24 million from TWD 650.76 million the previous year, sales rose significantly to TWD 3,916.84 million from TWD 3,148.96 million, showcasing robust demand for its products. The company has also initiated a buyback program for up to 5 million shares valued at TWD 1,350 million as part of efforts to enhance shareholder value and corporate credibility amidst volatile market conditions over the past three months.

Next Steps

- Reveal the 2607 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9958

Century Iron and Steel IndustrialLtd

Century Iron and Steel Industrial Co.,Ltd.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives