Investors ignore increasing losses at FSM Holdings (HKG:1721) as stock jumps 11% this past week

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the FSM Holdings Limited (HKG:1721) share price is up 37% in the last 5 years, clearly besting the market return of around 14% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 4.7%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

FSM Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last 5 years FSM Holdings saw its revenue grow at 11% per year. That's a pretty good long term growth rate. While the share price has beat the market, compounding at 6% yearly, over five years, there's certainly some potential that the market hasn't fully considered the growth track record. If revenue growth can maintain for long enough, it's likely profits will flow. There's no doubt that it can be difficult to value pre-profit companies.

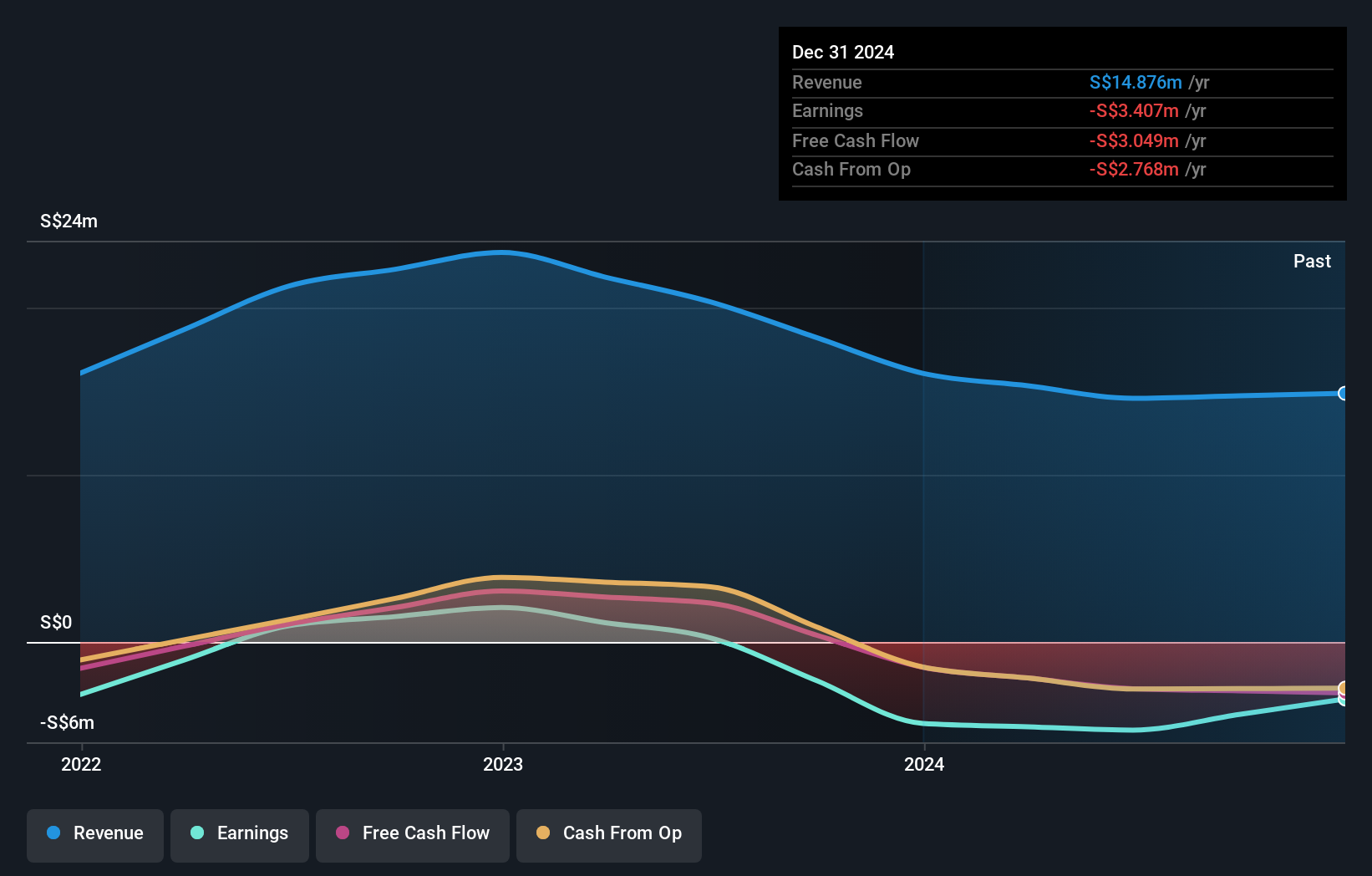

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling FSM Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

FSM Holdings shareholders are up 4.7% for the year. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 6% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for FSM Holdings (1 is significant!) that you should be aware of before investing here.

We will like FSM Holdings better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1721

FSM Holdings

An investment holding company, operates as a sheet metal fabricator in Singapore and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives