- Hong Kong

- /

- Construction

- /

- SEHK:1693

BGMC International Limited's (HKG:1693) 48% Price Boost Is Out Of Tune With Revenues

BGMC International Limited (HKG:1693) shareholders are no doubt pleased to see that the share price has bounced 48% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

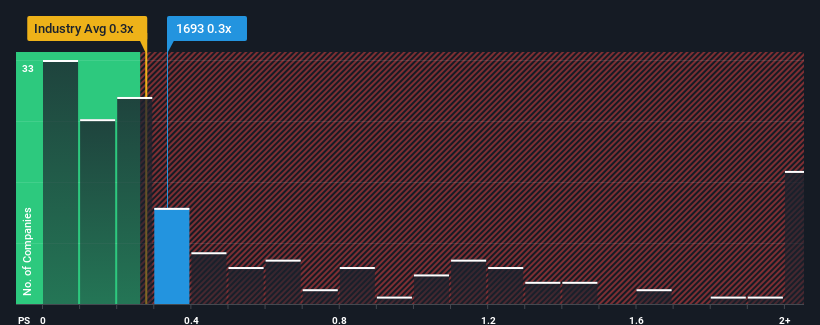

Even after such a large jump in price, there still wouldn't be many who think BGMC International's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when it essentially matches the median P/S in Hong Kong's Construction industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for BGMC International

What Does BGMC International's Recent Performance Look Like?

The recent revenue growth at BGMC International would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on BGMC International's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, BGMC International would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 6.3% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 63% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 9.9% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that BGMC International is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

BGMC International's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We find it unexpected that BGMC International trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with BGMC International, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on BGMC International, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if BGMC International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1693

BGMC International

An investment holding company, provides construction services in Malaysia.

Slight and slightly overvalued.

Market Insights

Community Narratives