- Hong Kong

- /

- Construction

- /

- SEHK:1662

Shareholders Will Probably Be Cautious Of Increasing Yee Hop Holdings Limited's (HKG:1662) CEO Compensation At The Moment

Under the guidance of CEO Andrew Yan, Yee Hop Holdings Limited (HKG:1662) has performed reasonably well recently. As shareholders go into the upcoming AGM on 03 September 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

Check out our latest analysis for Yee Hop Holdings

Comparing Yee Hop Holdings Limited's CEO Compensation With the industry

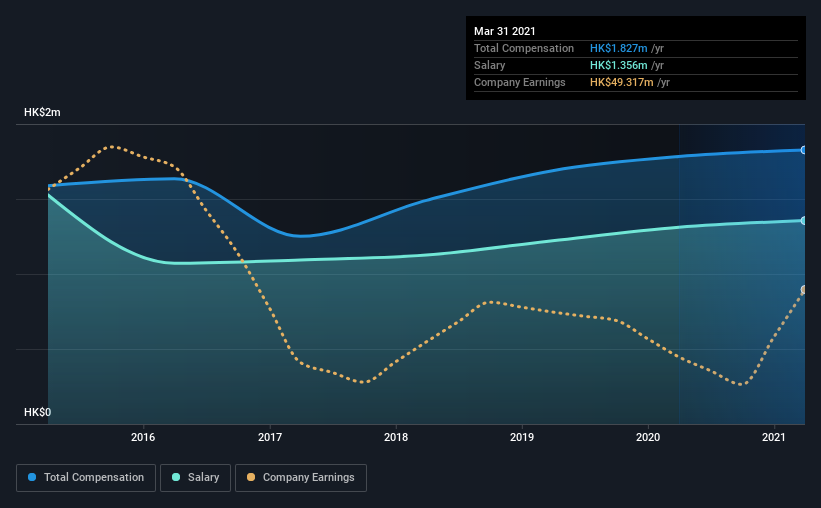

Our data indicates that Yee Hop Holdings Limited has a market capitalization of HK$880m, and total annual CEO compensation was reported as HK$1.8m for the year to March 2021. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at HK$1.36m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.8m. From this we gather that Andrew Yan is paid around the median for CEOs in the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$1.4m | HK$1.3m | 74% |

| Other | HK$471k | HK$471k | 26% |

| Total Compensation | HK$1.8m | HK$1.8m | 100% |

Talking in terms of the industry, salary represented approximately 90% of total compensation out of all the companies we analyzed, while other remuneration made up 10% of the pie. Yee Hop Holdings sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Yee Hop Holdings Limited's Growth

Yee Hop Holdings Limited has seen its earnings per share (EPS) increase by 18% a year over the past three years. It achieved revenue growth of 7.8% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Yee Hop Holdings Limited Been A Good Investment?

Yee Hop Holdings Limited has not done too badly by shareholders, with a total return of 4.8%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 3 warning signs for Yee Hop Holdings (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1662

Yee Hop Holdings

An investment holding company, provides engineering and construction services in Hong Kong, the People’s Republic of China, and the Philippines.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026