The one-year decline in earnings for Haina Intelligent Equipment International Holdings HKG:1645) isn't encouraging, but shareholders are still up 14% over that period

It might be of some concern to shareholders to see the Haina Intelligent Equipment International Holdings Limited (HKG:1645) share price down 15% in the last month. But that doesn't change the fact that the returns over the last year have been pleasing. In that time we've seen the stock easily surpass the market return, with a gain of 14%.

While the stock has fallen 12% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Haina Intelligent Equipment International Holdings

Given that Haina Intelligent Equipment International Holdings only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Haina Intelligent Equipment International Holdings saw its revenue shrink by 16%. Despite the lack of revenue growth, the stock has returned a solid 14% the last twelve months. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

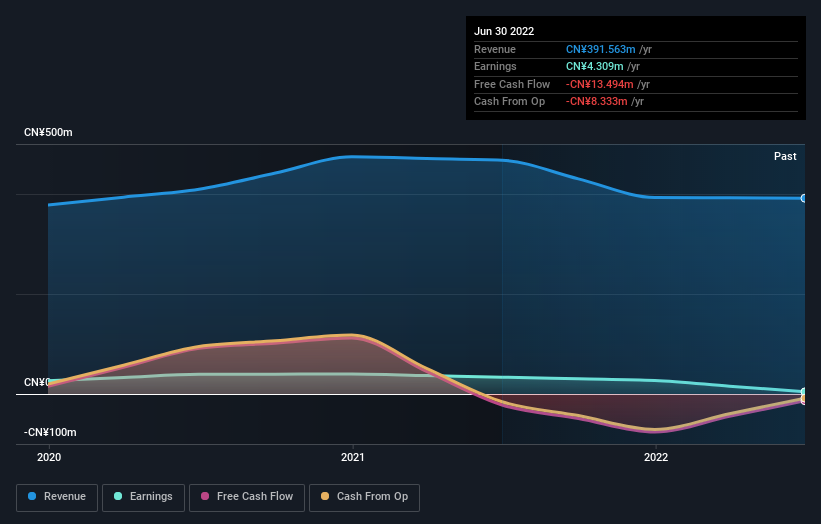

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Haina Intelligent Equipment International Holdings shareholders should be happy with the total gain of 14% over the last twelve months. And the share price momentum remains respectable, with a gain of 3.4% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Haina Intelligent Equipment International Holdings (including 1 which is significant) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Haina Intelligent Equipment International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1645

Haina Intelligent Equipment International Holdings

An investment holding company, engages in the design and production of automated machines for manufacturing disposable hygiene products.

Low with worrying balance sheet.

Market Insights

Community Narratives