- Hong Kong

- /

- Construction

- /

- SEHK:1582

If You Had Bought CR Construction Group Holdings' (HKG:1582) Shares A Year Ago You Would Be Down 19%

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the CR Construction Group Holdings Limited (HKG:1582) share price slid 19% over twelve months. That's well below the market return of 6.1%. Because CR Construction Group Holdings hasn't been listed for many years, the market is still learning about how the business performs. Unfortunately the share price momentum is still quite negative, with prices down 13% in thirty days.

Check out our latest analysis for CR Construction Group Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

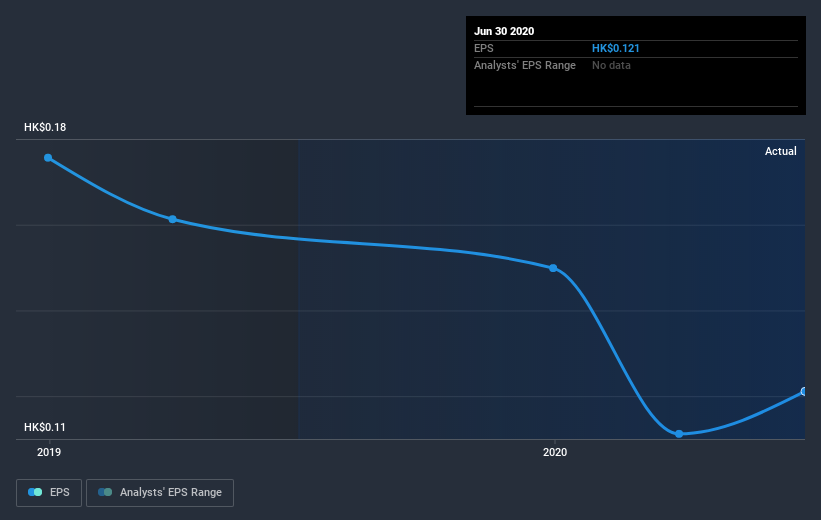

Unfortunately CR Construction Group Holdings reported an EPS drop of 23% for the last year. This fall in the EPS is significantly worse than the 19% the share price fall. It may have been that the weak EPS was not as bad as some had feared.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on CR Construction Group Holdings' earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, CR Construction Group Holdings' TSR for the last year was -5.7%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While CR Construction Group Holdings shareholders are down 5.7% for the year (even including dividends), the market itself is up 6.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline seems to have halted in the most recent three months, with the relatively flat share price suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand CR Construction Group Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with CR Construction Group Holdings (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading CR Construction Group Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1582

CR Construction Group Holdings

An investment holding company, operates as a building contractor in Hong Kong, Mainland China, Malaysia, and the United Kingdom.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives