- Hong Kong

- /

- Construction

- /

- SEHK:1547

IBI Group Holdings Limited's (HKG:1547) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- IBI Group Holdings' Annual General Meeting to take place on 6th of September

- Total pay for CEO Neil Howard includes HK$2.60m salary

- The overall pay is 55% above the industry average

- IBI Group Holdings' EPS declined by 81% over the past three years while total shareholder loss over the past three years was 14%

In the past three years, shareholders of IBI Group Holdings Limited (HKG:1547) have seen a loss on their investment. Per share earnings growth is also lacking, despite revenue growth. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 6th of September, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

See our latest analysis for IBI Group Holdings

Comparing IBI Group Holdings Limited's CEO Compensation With The Industry

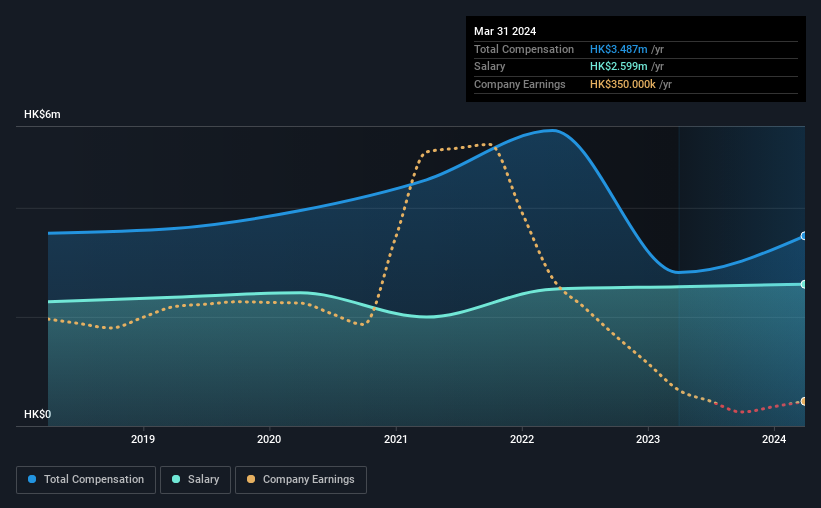

At the time of writing, our data shows that IBI Group Holdings Limited has a market capitalization of HK$180m, and reported total annual CEO compensation of HK$3.5m for the year to March 2024. That's a notable increase of 24% on last year. We note that the salary portion, which stands at HK$2.60m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Hong Kong Construction industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.3m. Accordingly, our analysis reveals that IBI Group Holdings Limited pays Neil Howard north of the industry median. Furthermore, Neil Howard directly owns HK$94m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$2.6m | HK$2.6m | 75% |

| Other | HK$888k | HK$258k | 25% |

| Total Compensation | HK$3.5m | HK$2.8m | 100% |

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. In IBI Group Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at IBI Group Holdings Limited's Growth Numbers

Over the last three years, IBI Group Holdings Limited has shrunk its earnings per share by 81% per year. Its revenue is up 71% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has IBI Group Holdings Limited Been A Good Investment?

With a three year total loss of 14% for the shareholders, IBI Group Holdings Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 4 warning signs for IBI Group Holdings (1 is a bit unpleasant!) that you should be aware of before investing here.

Switching gears from IBI Group Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1547

IBI Group Holdings

An investment holding company, offers interior fit-outs, building refurbishments, and other building services in Hong Kong, Macau, and Ireland.

Excellent balance sheet and fair value.

Market Insights

Community Narratives