- Hong Kong

- /

- Construction

- /

- SEHK:1500

If EPS Growth Is Important To You, In Construction Holdings (HKG:1500) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like In Construction Holdings (HKG:1500), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for In Construction Holdings

How Fast Is In Construction Holdings Growing Its Earnings Per Share?

In the last three years In Construction Holdings' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, In Construction Holdings' EPS grew from HK$0.035 to HK$0.075, over the previous 12 months. It's a rarity to see 117% year-on-year growth like that.

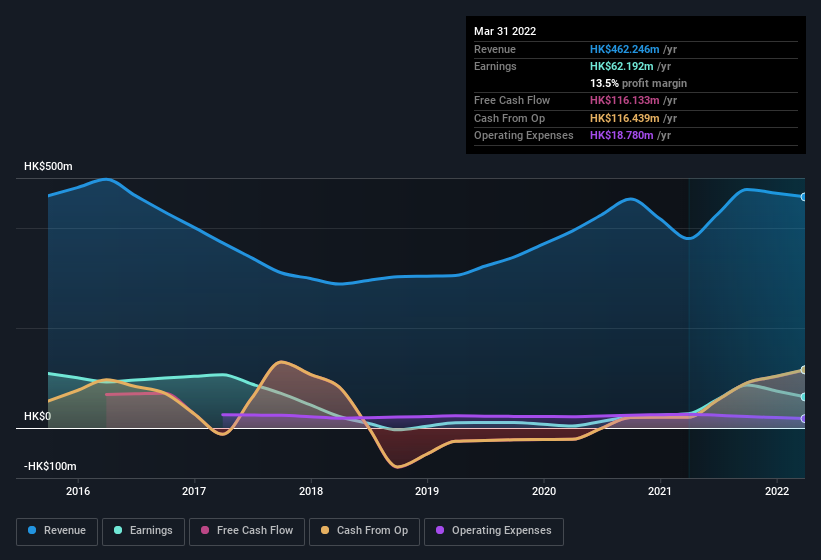

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that In Construction Holdings is growing revenues, and EBIT margins improved by 7.9 percentage points to 16%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since In Construction Holdings is no giant, with a market capitalisation of HK$191m, you should definitely check its cash and debt before getting too excited about its prospects.

Are In Construction Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's nice to see that there have been no reports of any insiders selling shares in In Construction Holdings in the previous 12 months. So it's definitely nice that Independent Non-Executive Director Chi Man Yau bought HK$346k worth of shares at an average price of around HK$0.24. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in In Construction Holdings.

And the insider buying isn't the only sign of alignment between shareholders and the board, since In Construction Holdings insiders own more than a third of the company. Indeed, with a collective holding of 74%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have HK$142m invested in the business, at the current share price. That's nothing to sneeze at!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because In Construction Holdings' CEO, Pak Man Lau, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to In Construction Holdings, with market caps under HK$1.6b is around HK$1.9m.

The In Construction Holdings CEO received HK$1.6m in compensation for the year ending March 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is In Construction Holdings Worth Keeping An Eye On?

In Construction Holdings' earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bunch of shares, and one has been buying more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest In Construction Holdings belongs near the top of your watchlist. Even so, be aware that In Construction Holdings is showing 3 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

Keen growth investors love to see insider buying. Thankfully, In Construction Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1500

In Construction Holdings

An investment holding company, operates as a contractor in the foundation industry in Hong Kong.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026