- Hong Kong

- /

- Construction

- /

- SEHK:1459

Jujiang Construction Group (HKG:1459) Seems To Use Debt Quite Sensibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Jujiang Construction Group Co., Ltd. (HKG:1459) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Jujiang Construction Group

How Much Debt Does Jujiang Construction Group Carry?

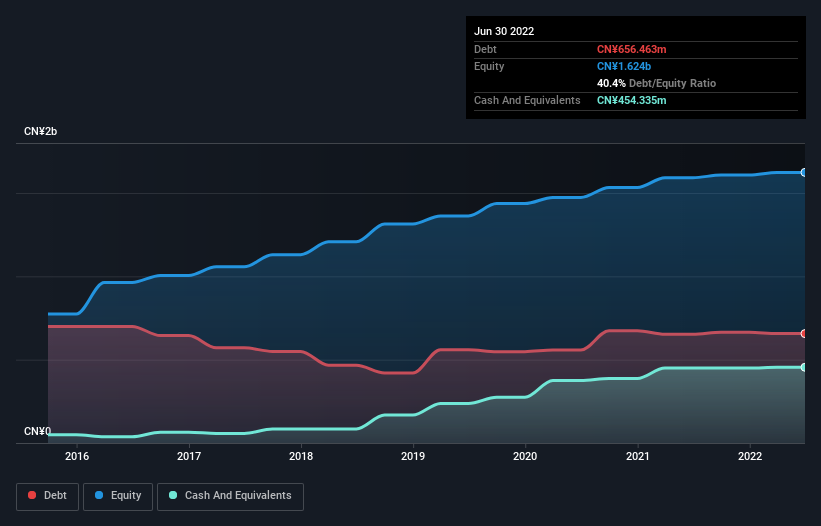

As you can see below, Jujiang Construction Group had CN¥656.5m of debt, at June 2022, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of CN¥454.3m, its net debt is less, at about CN¥202.1m.

How Healthy Is Jujiang Construction Group's Balance Sheet?

The latest balance sheet data shows that Jujiang Construction Group had liabilities of CN¥3.96b due within a year, and liabilities of CN¥159.4m falling due after that. Offsetting this, it had CN¥454.3m in cash and CN¥3.93b in receivables that were due within 12 months. So it can boast CN¥256.9m more liquid assets than total liabilities.

This surplus liquidity suggests that Jujiang Construction Group's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet means the company is able to handle some adversity.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Jujiang Construction Group's low debt to EBITDA ratio of 1.4 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 6.1 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. It is just as well that Jujiang Construction Group's load is not too heavy, because its EBIT was down 53% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But it is Jujiang Construction Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Jujiang Construction Group recorded free cash flow of 25% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Based on what we've seen Jujiang Construction Group is not finding it easy, given its EBIT growth rate, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its level of total liabilities. When we consider all the elements mentioned above, it seems to us that Jujiang Construction Group is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Jujiang Construction Group (1 can't be ignored) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1459

Jujiang Construction Group

Provides construction contracting services for residential, commercial, industrial, and public works in the People’s Republic of China and Hong Kong.

Adequate balance sheet slight.