- Hong Kong

- /

- Construction

- /

- SEHK:1447

Subdued Growth No Barrier To SFK Construction Holdings Limited (HKG:1447) With Shares Advancing 30%

The SFK Construction Holdings Limited (HKG:1447) share price has done very well over the last month, posting an excellent gain of 30%. Taking a wider view, although not as strong as the last month, the full year gain of 10% is also fairly reasonable.

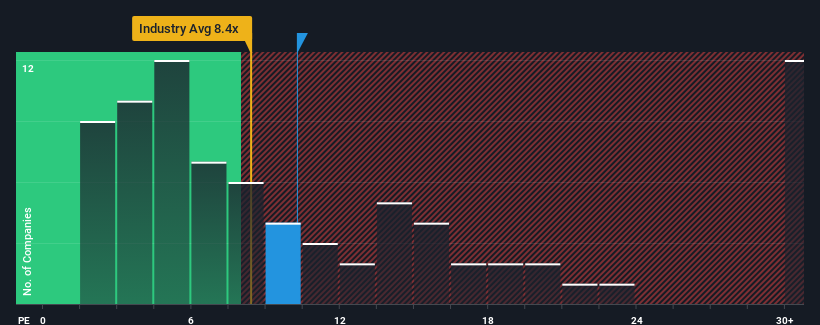

Although its price has surged higher, there still wouldn't be many who think SFK Construction Holdings' price-to-earnings (or "P/E") ratio of 10.3x is worth a mention when the median P/E in Hong Kong is similar at about 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been quite advantageous for SFK Construction Holdings as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for SFK Construction Holdings

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, SFK Construction Holdings would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 35% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's curious that SFK Construction Holdings' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

SFK Construction Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of SFK Construction Holdings revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with SFK Construction Holdings (at least 1 which can't be ignored), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than SFK Construction Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1447

SFK Construction Holdings

An investment holding company, engages in the construction and maintenance business primarily in Hong Kong.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives