- Hong Kong

- /

- Construction

- /

- SEHK:1427

Introducing China Tianbao Group Development (HKG:1427), A Stock That Climbed 35% In The Last Year

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. For example, the China Tianbao Group Development Company Limited (HKG:1427) share price is up 35% in the last year, clearly besting the market return of around 7.5% (not including dividends). So that should have shareholders smiling. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for China Tianbao Group Development

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, China Tianbao Group Development actually saw its earnings per share drop 22%.

So we don't think that investors are paying too much attention to EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

However the year on year revenue growth of 57% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

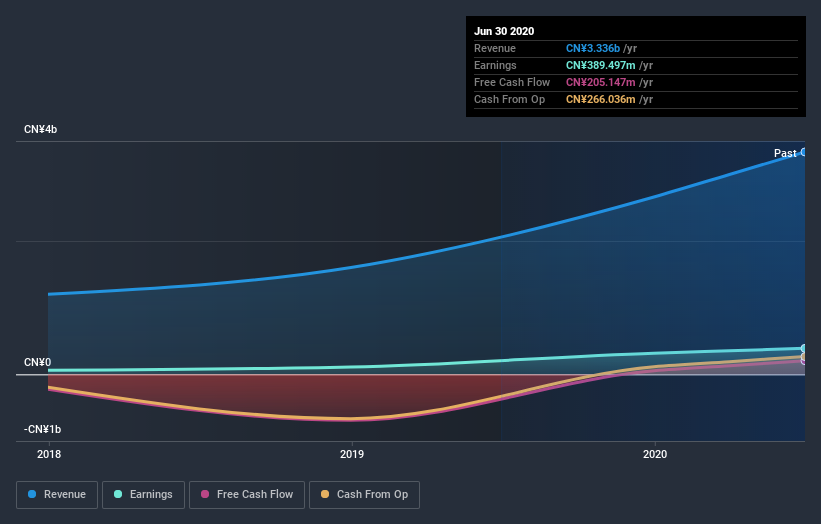

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that China Tianbao Group Development shareholders have gained 37% over the last year, including dividends. The more recent returns haven't been as impressive as the longer term returns, coming in at just 5.0%. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). It's always interesting to track share price performance over the longer term. But to understand China Tianbao Group Development better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with China Tianbao Group Development , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade China Tianbao Group Development, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1427

China Tianbao Group Development

Operates as a property developer and construction company in the People's Republic of China.

Good value low.

Market Insights

Community Narratives