- Hong Kong

- /

- Construction

- /

- SEHK:1413

Revenues Tell The Story For Kwong Luen Engineering Holdings Limited (HKG:1413)

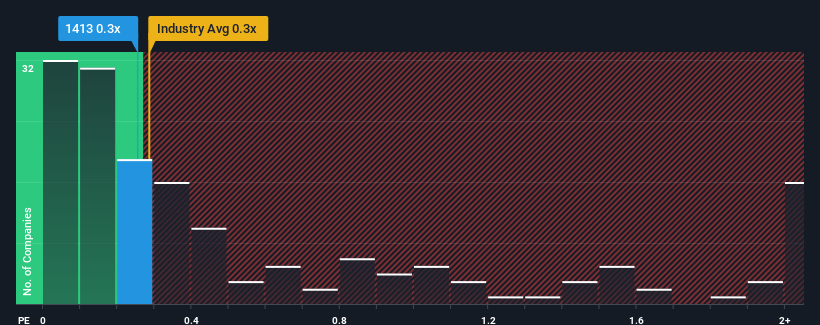

There wouldn't be many who think Kwong Luen Engineering Holdings Limited's (HKG:1413) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Construction industry in Hong Kong is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Kwong Luen Engineering Holdings

How Has Kwong Luen Engineering Holdings Performed Recently?

With revenue growth that's exceedingly strong of late, Kwong Luen Engineering Holdings has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. Those who are bullish on Kwong Luen Engineering Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kwong Luen Engineering Holdings' earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Kwong Luen Engineering Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 83% last year. The latest three year period has also seen a 28% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 10% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, it's clear to see why Kwong Luen Engineering Holdings' P/S matches up closely to its industry peers. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we've seen, Kwong Luen Engineering Holdings' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Having said that, be aware Kwong Luen Engineering Holdings is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

If these risks are making you reconsider your opinion on Kwong Luen Engineering Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1413

FEG Holdings

An investment holding company, operates as a foundation works contractor in residential and non-residential developments in Hong Kong.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives