- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1341

3 Promising Penny Stocks With Over US$400M Market Cap

Reviewed by Simply Wall St

As global markets navigate a complex landscape of shifting economic indicators, including rate cuts by the European Central Bank and fluctuating oil prices, investors are increasingly exploring diverse opportunities across various market segments. Penny stocks, often representing smaller or less-established companies, remain an intriguing area for those seeking potential value beyond traditional blue-chip investments. Despite their vintage moniker, penny stocks can offer significant returns when backed by strong financials and growth potential; this article highlights three such promising candidates that combine balance sheet strength with the possibility for substantial gains.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.595 | MYR2.96B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.975 | £189.41M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.76 | MYR131.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.28 | CN¥2.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.925 | MYR307.05M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.54 | MYR2.57B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.05 | £402.8M | ★★★★☆☆ |

Click here to see the full list of 5,787 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Hao Tian International Construction Investment Group (SEHK:1341)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hao Tian International Construction Investment Group Limited is an investment holding company involved in the rental and trade of construction machinery across Hong Kong, the United Kingdom, China, Malaysia, Cambodia, and Macau with a market cap of HK$3.24 billion.

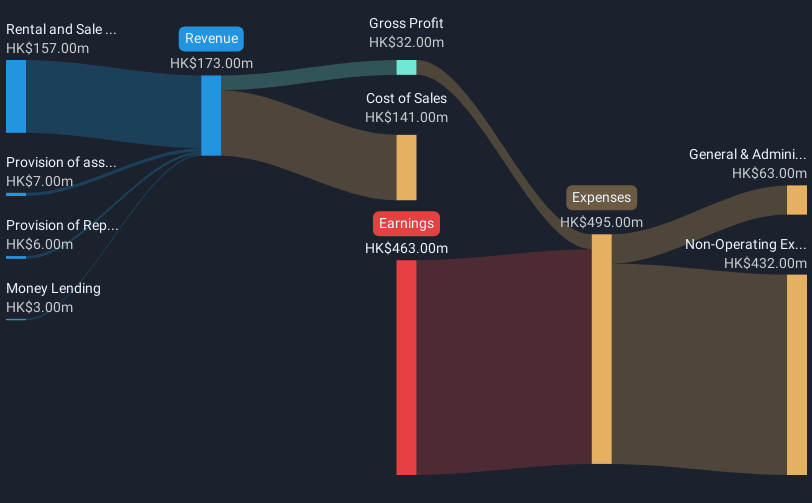

Operations: The company's revenue is primarily derived from the rental and sale of construction machinery and spare parts, generating HK$157 million, supplemented by money lending at HK$3 million, provision of repair and maintenance and transportation services at HK$6 million, and asset management, securities brokerage, and other financial services contributing HK$7 million.

Market Cap: HK$3.24B

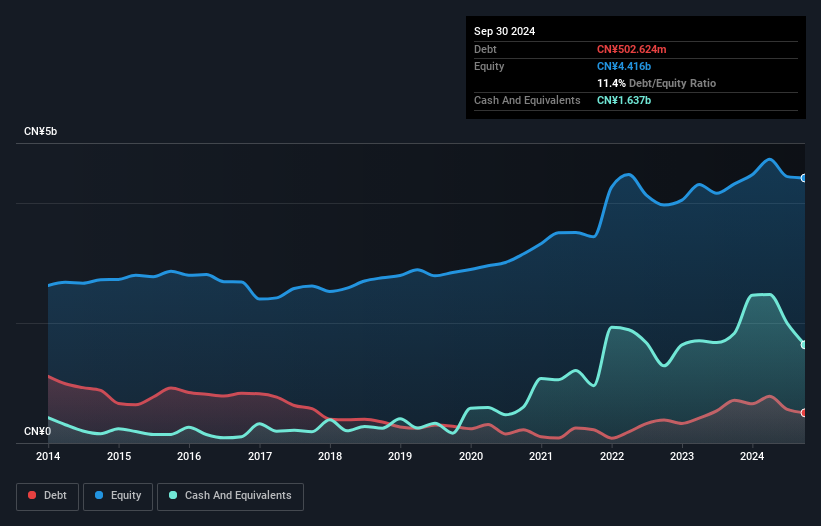

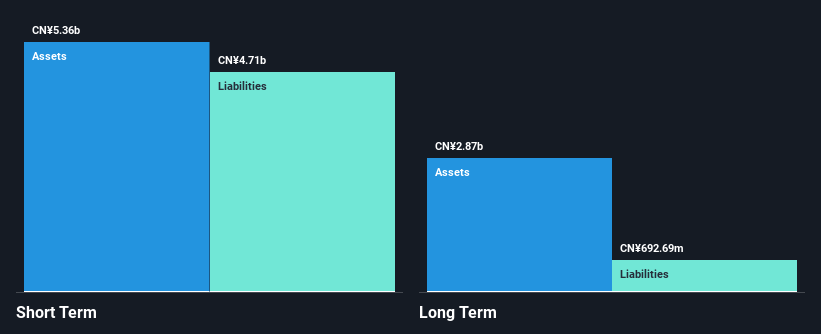

Hao Tian International Construction Investment Group, with a market cap of HK$3.24 billion, primarily generates revenue from the rental and sale of construction machinery. Despite being unprofitable, the company maintains sufficient short-term assets to cover liabilities and has a cash runway for over a year based on current free cash flow. The management team is experienced, though recent earnings have declined significantly over five years. A follow-on equity offering of HK$609 million was filed recently, potentially impacting shareholder value but providing additional capital for operations. The company's share price remains highly volatile compared to most Hong Kong stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Hao Tian International Construction Investment Group.

- Evaluate Hao Tian International Construction Investment Group's historical performance by accessing our past performance report.

Baoxiniao Holding (SZSE:002154)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baoxiniao Holding Co., Ltd. is involved in the research, development, production, and sale of branded clothing products in China with a market cap of CN¥6.01 billion.

Operations: The company generates revenue primarily from its Textile and Apparel segment, amounting to CN¥5.11 billion.

Market Cap: CN¥6.01B

Baoxiniao Holding, with a market cap of CN¥6.01 billion, primarily generates revenue from its Textile and Apparel segment. Recent financials show stable revenue at CN¥2.48 billion for the first half of 2024, though net income decreased to CN¥343.99 million from the previous year. The company's debt is well-covered by operating cash flow, and it holds more cash than total debt, indicating strong liquidity management. However, earnings growth has slowed compared to its five-year average. A recent private placement aims to raise nearly CN¥800 million but awaits regulatory approvals; this could influence future capital structure and shareholder value.

- Get an in-depth perspective on Baoxiniao Holding's performance by reading our balance sheet health report here.

- Explore Baoxiniao Holding's analyst forecasts in our growth report.

Nanfang Zhongjin Environment (SZSE:300145)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nanfang Zhongjin Environment Co., Ltd., with a market cap of CN¥5.71 billion, operates in the general equipment manufacturing business through its subsidiaries.

Operations: Nanfang Zhongjin Environment Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥5.71B

Nanfang Zhongjin Environment, with a market cap of CN¥5.71 billion, has shown significant earnings growth of 50.2% over the past year, surpassing its five-year average and outperforming the broader Machinery industry. Despite a decline in revenue to CN¥2.21 billion for the first half of 2024, net income improved to CN¥164.13 million from last year. The company's financial position is bolstered by strong short-term assets exceeding both short- and long-term liabilities, though it carries a high net debt-to-equity ratio of 65.3%. Notably, its debt is well-covered by operating cash flow and interest payments are not concerning.

- Click to explore a detailed breakdown of our findings in Nanfang Zhongjin Environment's financial health report.

- Gain insights into Nanfang Zhongjin Environment's outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Unlock our comprehensive list of 5,787 Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hao Tian International Construction Investment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1341

Hao Tian International Construction Investment Group

An investment holding company, engages in the rental and trade of construction machinery in Hong Kong, the United Kingdom, the People’s Republic of China, Malaysia, Cambodia, and Macau.

Mediocre balance sheet very low.

Market Insights

Community Narratives